Summary

Stubbornly sticky inflation has led to a repricing of interest rate expectations, with markets anticipating a slower and shallower easing cycle in most developed markets. Although US exceptionalism continues to fade, the Fed appears likely to be one of the last major central banks to start its easing cycle.

In currency markets, the extension of the US dollar (USD) carry story is allowing the dollar’s stretched valuation to persist beyond our expectation. This has left markets in limbo; unable to pivot to a new trend of dollar weakness, but reluctant to look for a new upswing in an already over-extended bull market. Against this backdrop, idiosyncratic stories have become increasingly important in driving individual currency performance. As November approaches, we expect an intense focus on US elections. A second Trump presidency has the potential for major trade disruption given it is likely to usher in a new era of trade protectionism.

In our educational topic this quarter we examine some of the world’s prominent geopolitical flashpoints and how they could be impacted by the results of the US election in November.

The Alpha view

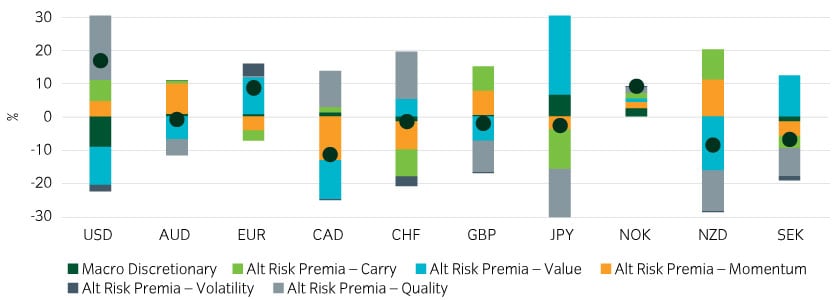

Our approach to generating returns in currency markets incorporates a diversified set of factors that cover key short and medium-term currency drivers. These latter include Macro themes, as well as an additional five risk premia – namely Carry, Momentum, Volatility, Value, and Quality. As mentioned above, our Macro investment process suggests there is a window of opportunity for the USD to weaken. This is especially so versus the Japanese yen (JPY) where the expected monetary policy divergence is the greatest. However, risk premia factors remain sufficiently supportive for the USD to outweigh valuation concerns, in our view. As such our overall position remains to be moderately long USD, as can be seen in Figure 1. Indeed, in our Alt Risk Premia model, the USD is being supported by the Carry, Quality, and Momentum factors which are only being partially offset by our Macro factor.

We are also moderately constructive on the euro (EUR) and Norwegian krone (NOK). Against that, we have a negative outlook on the Canadian dollar (CAD), New Zealand dollar (NZD) and to a smaller extent the Swedish krona (SEK).

Figure 1: Insight Currency Absolute Return Exposure

Source: Insight. Data as of June 14, 2024. Note: Black dot shows aggregate position.

Longer-term valuation overview

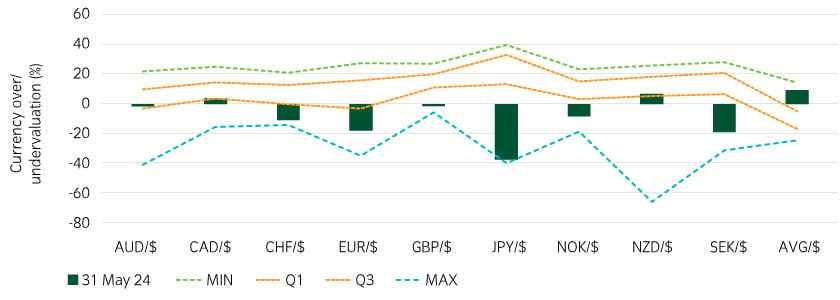

For less agile longer-term investors whose investment decisions lean more heavily on valuation metrics, a few points can be made:

- the USD remains overvalued (Figure 2), but not against all crosses – the NZD also looks moderately expensive;

- the JPY, EUR, SEK, and to a smaller extent the NOK, look cheap by historical standards; and

- the Australian dollar (AUD), CAD, and British pound (GBP) are close to fair value.

Figure 2: Local currency overvaluation (+) and undervaluation (-) versus USD

Source: Insight. Data as of May 31, 2024.

Most read

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Global Macro Research: Yield-curve inversion – an unreliable recession signal?

Responsible investment, Multi-asset, Fixed income, Solutions

November 2024

Australia

Australia