Summary

The current backdrop of gently easing global growth and falling rates has historically been consistent with a weaker USD. Indeed, over the past three months we have seen the USD soften against developed market currencies. However, this window of weakening is likely to shut soon as markets increase their focus on the US election taking place in November.

While we see a win for Harris as being broadly neutral for global growth, a Trump victory is likely to be more negative, particularly under a split government. For currency markets, this suggests that a Harris victory would be moderately negative for the US dollar (USD), while a win for President Trump would support the USD, especially in the event of a Republican sweep. This was certainly the experience of the months following Trump’s election in 2016 and during the trade war in 2018- 2019.

Another factor likely to offer the USD some short-term support is our belief that markets have over-estimated the Federal Reserve's terminal policy rate and thus overestimating the impact of lower future interest rates on the USD. We see stubborn inflation and above trend US growth resulting in a terminal policy rate of approximately 3.25%.

The Alpha view

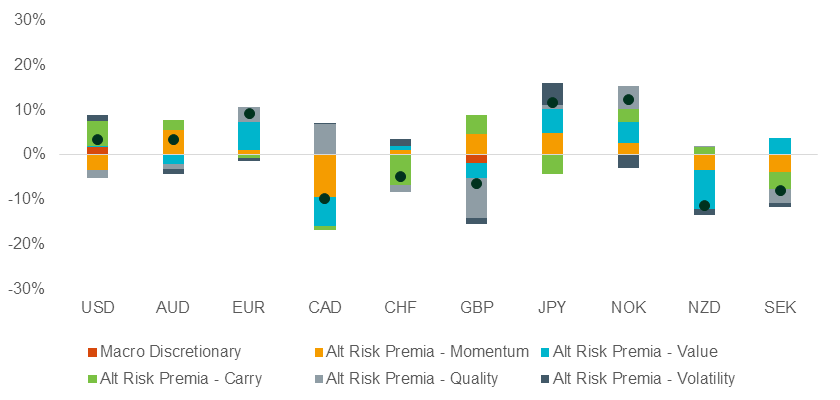

Our approach to generating returns in currency markets uses a diversified set of factors that cover key short and medium-term currency drivers. These latter include macro themes, as well as an additional five risk premia – namely Carry, Momentum, Volatility, Value, and Quality.

Our exposure in the macro space is limited. We believe the market is too aggressive in pricing in US rate cuts, so our current bias is for the USD to trade lower. However, this is unlikely to be the case if President Trump wins the election. A month after the 2016 election the USD appreciated 2% versus developed market currencies and 7% during the 2018-19 trade war. The risks are skewed towards a more aggressive USD rally as the tariffs are likely to be higher during a second Trump presidency.

The risk premia factors are taking a very modest long USD exposure given the conflicting signals that stem from underlying factors. Instead, Alt Risk Premia model favours longs in JPY, Norwegian krone (NOK), euro (EUR), and Australian dollar (AUD) vs shorts in the Canadian dollar (CAD), Swiss franc (CHF), British pound (GBP), New Zealand dollar (NZD) and Swedish krona (SEK).

The overall portfolio seen in Figure 1, is broadly neutral the USD, but has a risk off bias to it.

Figure 1: Insight currency absolute return exposure

Source: Insight. Data as at 23 Sep 2024. Note: Black dot shows aggregate position.

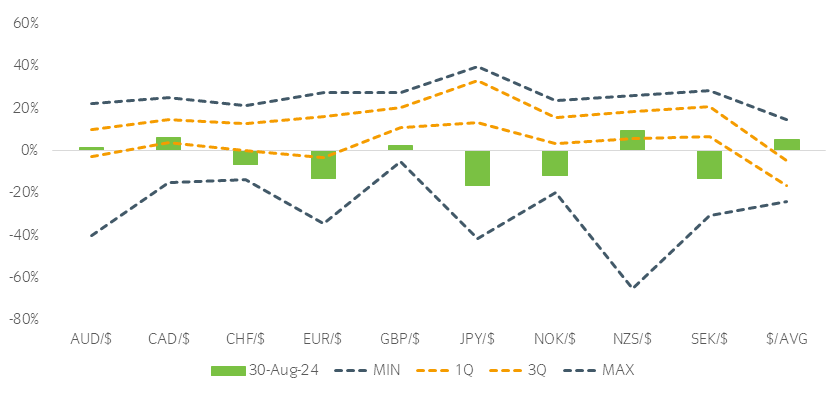

Longer-term valuation overview

For less agile longer-term investors whose investment decisions lean more heavily on valuation metrics, a few points can be made:

- the USD remains overvalued (Figure 2 ), but not as much as it used to be. The NZD is also moderately expensive;

- the JPY, EUR, SEK, and to a smaller extent NOK look cheap by historical standards;

- the AUD, CAD, and GBP are close to fair value.

Figure 2: Local currency overvaluation (+) and undervaluation (-) versus USD

Source: Insight. Data as at 30 Aug 2024.

Most read

Multi-asset

April 2025

Multi asset chart of the week

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Australia

Australia