High yield default rates at the index level have been historically lower than ratings agency estimates. It could be time to reconsider high yield’s compensation for risk

Ratings agency high yield corporate default rates may be misleading

When investors consider allocating to high yield, especially for a strategic, buy and hold allocation, their chief concern is securing credit spreads that adequately compensate for defaults.

However, while corporate high yield index credit spread data is readily available, index default rates are not.

Therefore, investors typically rely on default rates reported by ratings agencies, such as Moody’s, which state global corporate high yield default rates are approaching 5% (see Figure 1).

Figure 1: Ratings agency default rates indicate 3-4% default rates

Source: Moody’s Annual Default Study, February 2024

Moody’s also reports historic credit loss rates (which adjust default rates by default recoveries). The latest is 3.2% – the same level as current global high yield credit spreads and the average is 2.3%. This indicates 0% to 1% excess return over the next year (Figure 2).

Figure 2: These default rates indicate that credit spreads offer little compensation for credit loss risks

Source: Bloomberg Global High Yield Index, Moody’s Annual Default Study. Spread as of November 2024, average loss rate 2005 to 2023.

Actual high yield index default rates have often been significantly lower

Insight’s systematic fixed income team has calculated actual historical default rates within the high yield indices, allowing a direct comparison of credit spreads to defaults.

Outside of the most difficult markets, actual defaults have tended to be ~25% lower than Moody’s estimates on average. The latest credit loss rate stands at 2.3% and the average is 1.74% (Figure 3).

Figure 3: High index default rates have generally been lower than Moody’s estimates for most periods

Source: Bloomberg Global High Yield Index, Insight, November 2024.Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

These figures indicate between 0.9% and 1.5% excess return over the next year, indicating a significantly greater valuation buffer than Moody’s data suggests (Figure 4).

Figure 4: Compensation for default risks may be significantly higher than Moody’s estimates

Source: Bloomberg Global High Yield Index, Insight, November 2024.Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

Why do index defaults differ from ratings agency calculations?

There are three key reasons that index and ratings agency default rates have differed.

Figure 5: Outside of stressed markets, index defaults have been consistently lower

Source: Bloomberg Global High Yield Index, Moody’s Annual Default Study. Spread as of November 2024, average loss rate 2005 to 2023.

- The Moody’s universe is wider: The agency’s universe includes a broader set of companies that issue both fixed-coupon and floating-rate debt as well as unrated issuers, private companies and smaller entities that tend to have concentrated business models with higher default risk.

- The Moody’s universe is equally weighted: This makes default estimates more sensitive to small issuers and does not reflect most high yield investments, which are weighted by market cap. A market cap weighting also tends to skew indices to fallen angels (former investment grade companies) which tend to be larger businesses with higher credit ratings than other high yield names.

- High yield indices exclude bonds shorter than 1-year: This rule may help mitigate defaults during periods of heightened stress, when near-term default risk can be higher than longer-term default risk, when spread curves have tended to flatten or invert.

| Moody’s US Speculative Grade Default Rate | Bloomberg US HY Index Default Rate | |

| Universe Difference |

|

|

| Weighing Methodology Difference |

|

|

| Maturity dates |

|

|

Conclusion: think again about high yield valuations

We believe high yield markets may offer better compensation for risks than most investors realise. Where investors’ default expectations are based on rating agencies, they may overestimate default risk and therefore underestimate valuations. Adjusting current yields on global high yield indices by historical average Moody’s default rates makes the asset class seem to offer no tangible benefit over investing in BBB corporates. However, when adjusting for actual default rates, high yield markets may present a notable potential premium over BBBs (Figure 6).

Figure 6: Yields on high yield markets after credit losses may be more compelling than you think

Source : Bloomberg Global High Yield Index, Moody’s Annual Default Study. Spread as of November 2024, average loss rates 2005 to 2023. Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

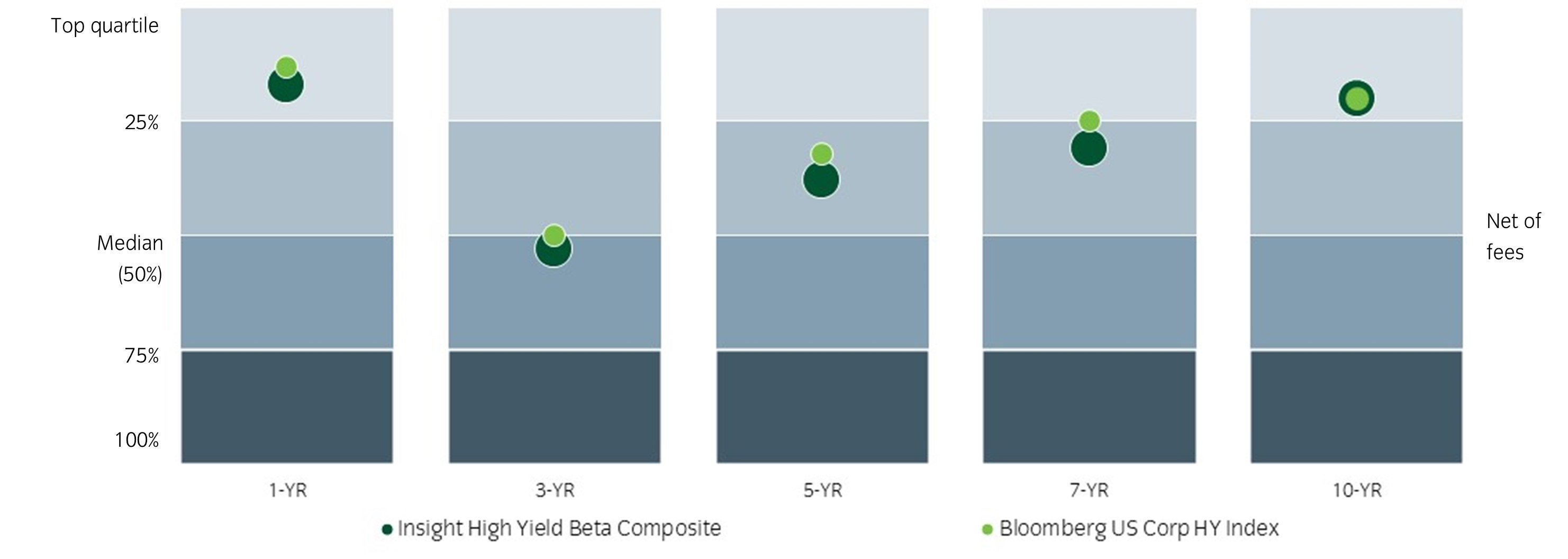

Although there may be more value in high yield than investors generally believe, in our view, investors should consider how best to capture it. Historically most active and passive strategies have struggled to outperform broad high yield indices due to frictional headwinds like transaction costs. Manager selection is therefore crucial. We believe investors way wish to consider systematic approaches with proven track records, that can aim to overcome trading frictions.

Figure 7: Reliably extracting available value from high yield may be achievable with a systematic approach

Source: eVestment Alliance as of September 30, 2024. Benchmark: Bloomberg US Corp HY Index. Past performance is no assurance of future returns. Investment in any of these strategies involves a risk of loss. Data is shown net of fees in USD. Performance shown herein contain results of accounts managed by the portfolio managers at a predecessor firm. The accounts managed at the predecessor firm were similar to the accounts currently under management. The quoted benchmark does not reflect deductions for fees, expenses or taxes. The benchmark is unmanaged and does not reflect actual trading. There could be material factors relevant to any such comparison such as differences in the volatility, and regulatory and legal restrictions between the index shown and the strategy. Investors cannot invest directly in any index. Manager makes no assurances that performance targets will be achieved. Return targets do not reflect advisory fees and other expenses. US High Yield is represented by the eVestment US High Yield Universe. Number of observations in the universe: 154 (1 year), 150 (3 years), 143 (5 years), 129 (7 years), 103 (10 years).

Some returns, standard deviations, and other risk and efficiency statistics in this presentation, when indicated, are based on data provided by eVestment Alliance, an independent provider of performance data for registered investment advisers, and are believed to be accurate. Actual client returns may differ from those shown in the presentation. In addition, credit ratings referenced in this presentation, if applicable, are obtained from Nationally Recognized Statistical Rating Organization firms.

eVestment Alliance has provided the following disclosure: eVestment Alliance collects information directly from investment management firms and other sources believed to be reliable. eVestment Alliance does not guarantee or warrant the accuracy, timeliness, or completeness of the information either collected, sourced or otherwise provided to eVestment Alliance or its partners and is not responsible for any errors or omissions. Distribution of this content is covered under the Firm’s Service Agreement and is intended for full and complete internal use and for the Firm’s use in one-on-one discussions and projects with clients and prospects. Not intended for general or unsolicited distribution or for distribution outside of the terms of the Firm’s Agreement with eVestment Alliance.

Most read

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Global Macro Research: Yield-curve inversion – an unreliable recession signal?

Fixed income

January 2025