Green hydrogen: a source of energy with low emissions

There is growing interest among investors in more environmentally friendly methods of producing hydrogen, which could supply up to a fifth of the world’s energy by 20501, and is key to the decarbonisation pathway of industries such as shipping.

Globally, most hydrogen is produced from natural gas via steam methane reforming, a process by which methane is split to produce carbon monoxide and hydrogen. A substantial proportion is also produced through coal gasification, whereby coal is processed to produce a gas consisting of hydrogen as well as carbon monoxide and carbon dioxide (CO2).2 These emissions may be reduced using carbon capture and storage (CCS) technologies.

By contrast, green hydrogen is produced using an electrical current to break down water molecules into oxygen and hydrogen. As it is created using renewable energy, green hydrogen has very low associated emissions – and moving to a higher proportion of green hydrogen in the global energy mix is widely deemed a necessary element of the global transition to net zero.

The development, production and adoption of green hydrogen face significant challenges

Challenges facing the development and adoption of green hydrogen include the uncertainty associated with its dependence on government support and policy, and with the development of future technology.

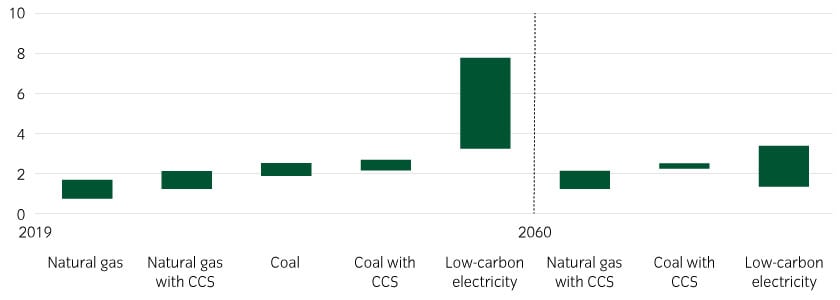

The economics of green hydrogen are a meaningful hurdle. The cost of producing green hydrogen is much higher today than via other means – though this is projected to fall materially by 2060 (see Figure 1).

Figure 1: Global average levelised cost of hydrogen production by energy source and technology (USD per kg)3

For the price to fall as projected, policy support and subsidies will be necessary to incentivise adoption at the early stages of transition, and to drive ongoing research and development.

Other challenges include the need for new manufacturing, storage and transportation supply chains. Storage costs are high, and there are trade-offs to navigate around whether production should be near power-generation sources or end demand. Accessing sufficient water resources is another consideration.

As the market evolves and scale increases, the best template could be liquified natural gas, where non-integrated third parties provide distribution and storage services. Sponsors will need to put reliable long-term arrangements in place to lock in the availability and pricing of transportation and storage, with customary shipping terms that financiers find acceptable. Some companies in the ports and logistics sector in early-mover countries such as Australia are looking to build transport and storage capacity.

Policy support is driving development and financial support

Governments and state actors have a key role to play in supporting the necessary infrastructure buildout, and there is strong momentum – over 2021-2022, nine countries responsible for 30% of global energy sector emissions published national hydrogen strategies1. Examples include the following:

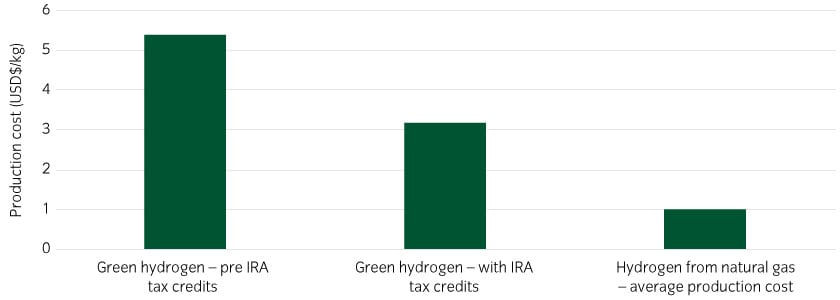

- In the US, US$8bn of competitive funding for regional hydrogen hubs announced in 2022 under the US Infrastructure Investment and Jobs Act, has led to a number of multi-state public private partnerships – typically based on hydrogen produced using CCS and leveraging existing natural gas resources, although a partnership between seven states in the northeast is focusing on green hydrogen2. Tax credits under the Inflation Reduction Act offer producers up to USD3 per kilogram of hydrogen, with potentially unlimited subsidy available via production tax credits. This is expected to significantly enhance the viability of new projects in the US – particularly as credits are more generous for projects deployed in 2023/2024.

Figure 2: US producers benefit from generous subsidies6

- In Europe, the RePowerEU Plan aims for 1.3 million tonnes of green hydrogen to be blended into existing gas networks, amounting to around 20% of supply. However, this could increase operating costs by at least a third whilst only delivering emissions reductions of 6% to 7%, driving up costs to end-consumers substantially whilst delivering a minimal reduction in emissions, given the far lower density of hydrogen relative to natural gas7. European governments will therefore need to subsidise the required ramp-up of renewable hydrogen for a considerable time, at an annual cost of €10-24bn across the EU to 2030, according to one study.8

To this end, the new €3bn European Hydrogen Bank will provide a subsidy of up to €4 per kilogram of green hydrogen, with the first auctions starting in autumn 2023.9

Nonetheless, use of green hydrogen will likely be limited to only those sectors that urgently need renewable hydrogen to become climate-neutral — namely ammonia, chemicals production, steel, long-term energy storage, long-haul aviation and maritime shipping (the latter two using fuels derived from green hydrogen).

-

In the UK, the government’s hydrogen strategy envisages hydrogen deployment as central to achieving the UK’s net-zero goal, and is targeting 10GW of low-carbon production capacity by 203010. This is based on a ‘twin track’ approach of policy support for both green hydrogen and fossil-fuel-derived hydrogen linked to CCS. Regulatory reform is seen as a key pillar in support of the market, and the government is exploring mixing of up to 20% of hydrogen into the existing UK gas-distribution network to support its domestic net-zero goal, given challenges to the rapid deployment of household heat pumps. This has raised some concerns regarding the implications for network operating costs and potential pass-through to consumers via higher gas prices.

This policy uncertainty, coupled with the generous, front-loaded support mechanisms offered to production in the US and EU, is likely to be highly detrimental to the deployment of new hydrogen projects in the UK out to 2025 given development and approval lead times.

State-owned energy companies have played a major role in hydrogen deployment, given they can be recipients of state guarantees and/or subsidies, which can reduce the risks associated with investing in this technology; as well as conduits for implementing public policy goals (such as increasing energy security). For example, China’s state-owned oil companies are seeking to develop their hydrogen production capacities, with Sinopec having earmarked CNY30bn to develop its hydrogen business over five years. In addition to existing fossil-fuel-based hydrogen production, the company also has four green hydrogen projects in development. PetroChina has announced similar plans for hydrogen expansion, although on a smaller scale. 11

|

Financial support for hydrogen projects from the private sector is emerging Most new projects to date use a combination of grant funding and concessional debt. The success of those projects could act as a catalyst for the emergence and deployment of mainstream external debt into the sector. External debt providers will typically have higher return hurdles and more conservative credit processes, resulting, at least initially, in external financing only being provided to projects with robust long-term offtake arrangements (meaning agreements are already set in place for the hydrogen to be purchased). Diversification of financing sources will be key to project viability – such as blending loans and bonds with other sources of support such as government guarantees. |

High costs continue to pose questions for governments

There is strong interest in green hydrogen, but the high cost relative to other forms of hydrogen present significant challenges.

Because natural gas is used for the majority of fossil-fuel hydrogen production today (and equates to around 6% of total global gas consumption), production costs and pricing are highly sensitive to local gas prices. Production is therefore typically most cost-effective in the Middle East and North America, whereas major gas importers face steep production costs – meaning such countries, like Japan, are looking to partner with producers such as Australia, where green hydrogen could be produced more cost-effectively.

Two other factors will drive whether the production of green hydrogen is more economic than producing hydrogen using fossil fuels: the cost of renewable energy and carbon pricing.

For renewable energy, the unit costs of renewable generation are projected to fall, which would in turn lead the cost of green hydrogen to fall around 30% by 2030, according to IEA analysis12. Notably, declines in these costs have generally outpaced projections historically.

On carbon pricing, the price under the EU Emissions Trading Scheme has recently hit record highs of over €100 per metric ton of CO2, due to tightening regulation and carbon markets. If these prices are sustained, the economic case for many more green hydrogen projects could become viable.

Analysis has indicated that the carbon price needs to be around €100 per metric ton of CO2 by 2030 for the cheapest renewable hydrogen to be competitive with fossil fuel-based hydrogen, but the price may need to reach as high as €300 per metric ton of CO2 for the cost of all renewable hydrogen to break even with fossil fuel-based hydrogen production. Furthermore, natural gas costs would remain cheaper than any hydrogen type if carbon prices do not exceed €100 per metric ton of CO2.8

However, outside the EU, carbon prices are either non-existent or far too low to incentivise this shift, so continued government support will be required to drive down production costs and improve the economic viability of hydrogen projects. China has recently set a target to produce 100,000 to 200,000 metric tons of green hydrogen annually by 2025, which if fully realised could help tilt the global economics and viability of the energy source13.

Nonetheless, aspects of green hydrogen costs (particularly transportation and storage) are likely to remain stubbornly high.

The high relative costs of green hydrogen pose questions about its role in achieving net zeroThe relative cost of green hydrogen projects therefore pose questions about the economic viability of green hydrogen as a technology solution for net-zero policy implementation where there are plausible alternatives, such as household heat pumps. However, the current energy crisis has highlighted the trade-offs governments are willing to make (at least temporarily) between energy security, affordability and sustainability concerns – meaning the higher relative cost of green hydrogen production may not, in isolation, put off governments from investing in it. |

Opportunities for investors are likely to emerge

For investors, price-support mechanisms for green hydrogen announced to date are heavily front-loaded, with a tapering of support towards 2030, driven by the intention to support the development of competitive marketplaces.

This points to growing opportunities in the green bond market (initially focused on the energy and utilities sector, but likely over time to expand to hard-to-abate industrial sectors) and transition finance.

Critically, the design of support mechanisms, such as state guarantees and subsidies, to reduce the risks associated with investing in this relatively new technology could help to reduce the risk premium for green hydrogen and open up opportunities for impact-focused investors.

Most read

Multi-asset

April 2025

Multi asset chart of the week

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Australia

Australia