Chart of the week

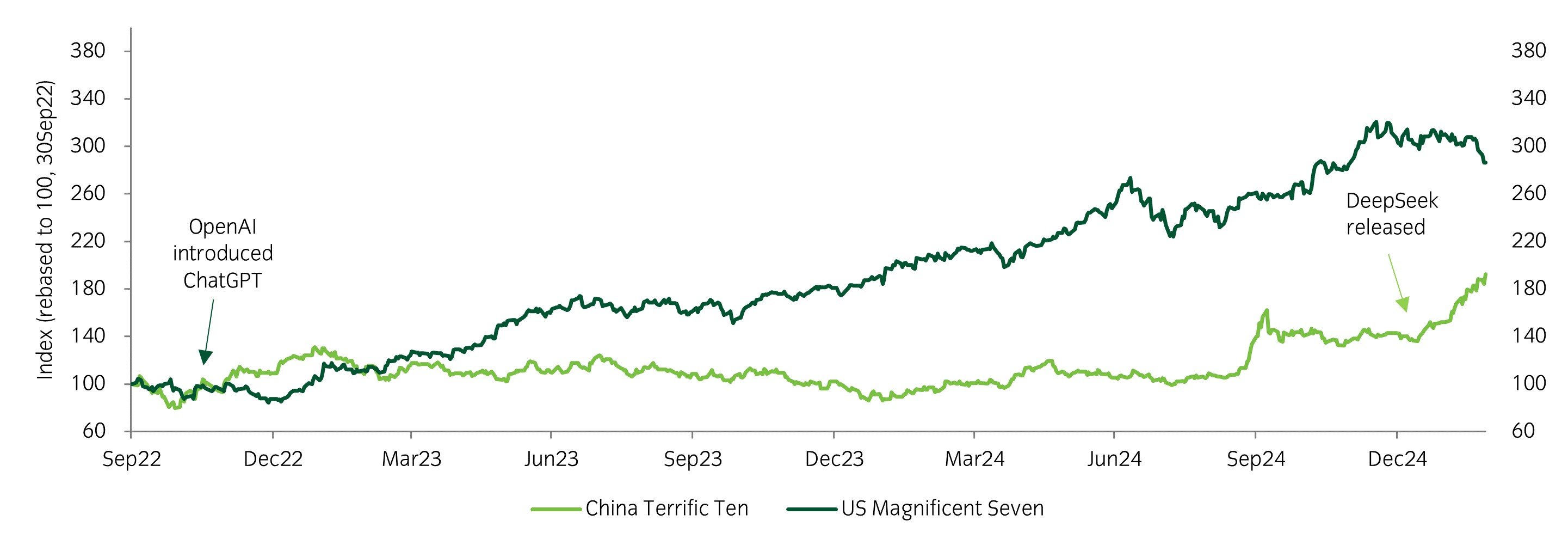

China’s Terrific Ten have surged since the release of DeepSeek whilst the US Magnificent Seven have lost momentum

Source: Bloomberg and Insight Investment as at 26 Feb 2025

- The US Magnificent Seven experienced significant gains following OpenAI’s introduction of ChatGPT in late 2022, reaching a peak in late 2024. This strong momentum has stalled this year partly over concerns on stretched valuations, as evidenced by some of the negative price action.

- China’s Terrific Ten1 have lagged their US counterparts over the past three years but have had a very strong start to 2025. One catalyst for the rally was the release of DeepSeek, coinciding with President Xi’s renewed engagement with private sector business leaders earlier this month and the first since a similar 2018 meeting. In the meeting Xi signalled state support for the tech industry which boosted investor confidence in the Chinese tech sector.

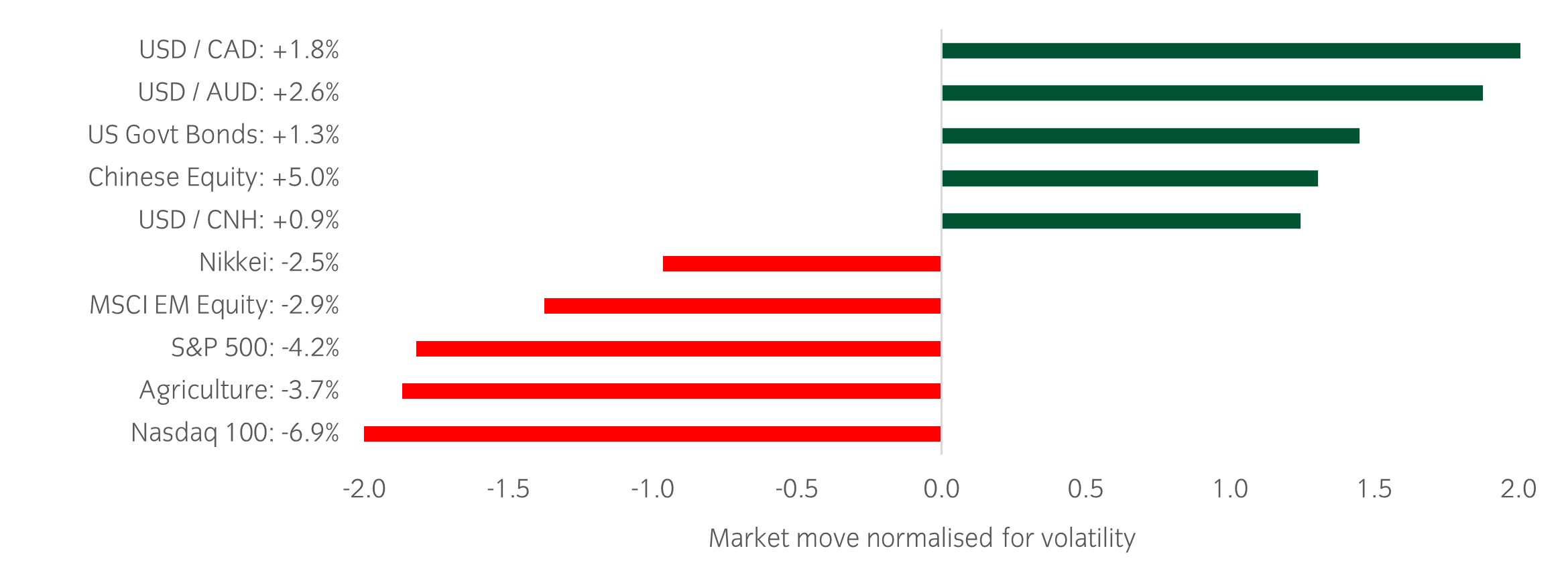

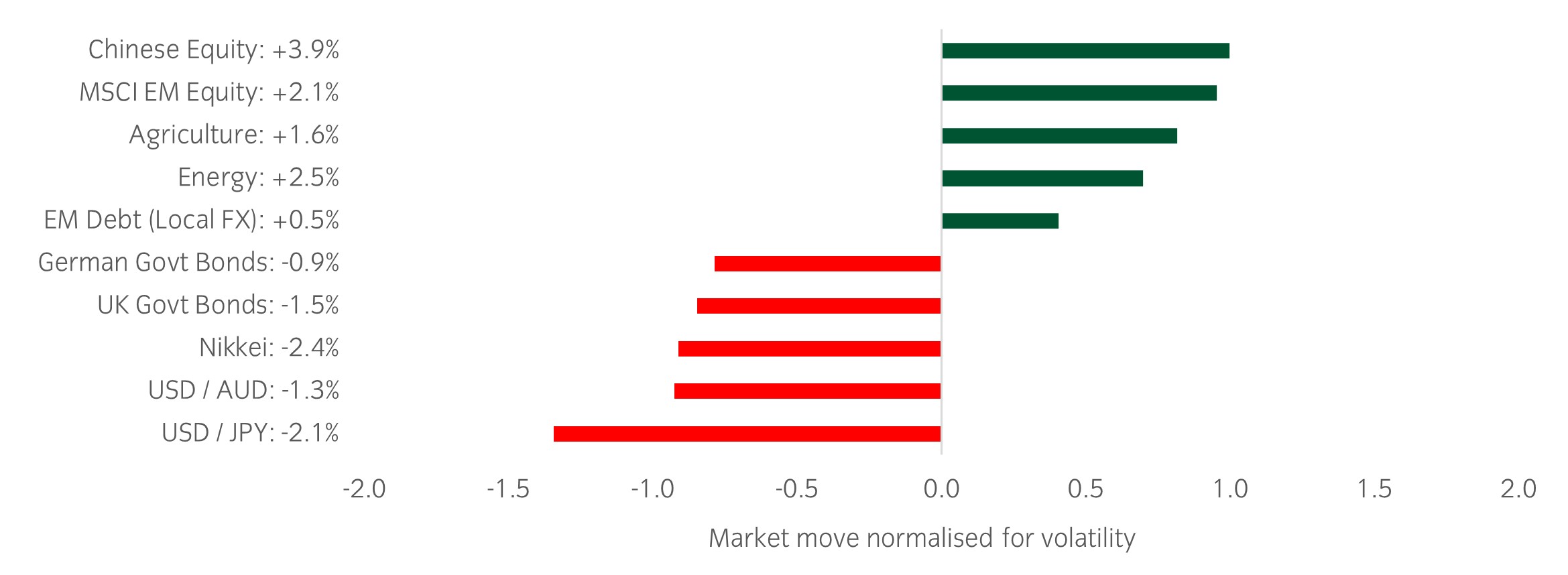

Significant market moves this week

Source: Bloomberg and Insight as at 28 February 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: Chinese and MSCI emerging market equities performed well, while the USD was generally weak following a strong run.

Over the past week, several things caught our eye:

- The German election was in focus, due to the potential impact of the results on European fiscal policy and increased defence spending. However, the process of forming a coalition for government could take several months and we are unlikely to receive clarity over policy direction for some time.

- The US and Ukraine are in talks for a deal on access to Ukraine’s mineral deposits, with the US demanding a share of revenue from Ukraine’s mineral deposits in exchange for investments and potential security guarantees for Ukraine. The US and Russia have also been discussing a potential ceasefire in the war between Russia and Ukraine. A ceasefire would greatly reduce geopolitical uncertainty in the region and would likely improve risk sentiment.

- US equities continued their decline amid fears of deteriorating growth in the US. The Conference Board’s Consumer Confidence Index came out lower than expected and initial jobless claims surprised to the upside. Furthermore, despite positive earnings results from Nvidia, the market showed scepticism over the sustainability of AI-fuelled earnings growth.

Asset allocation observation

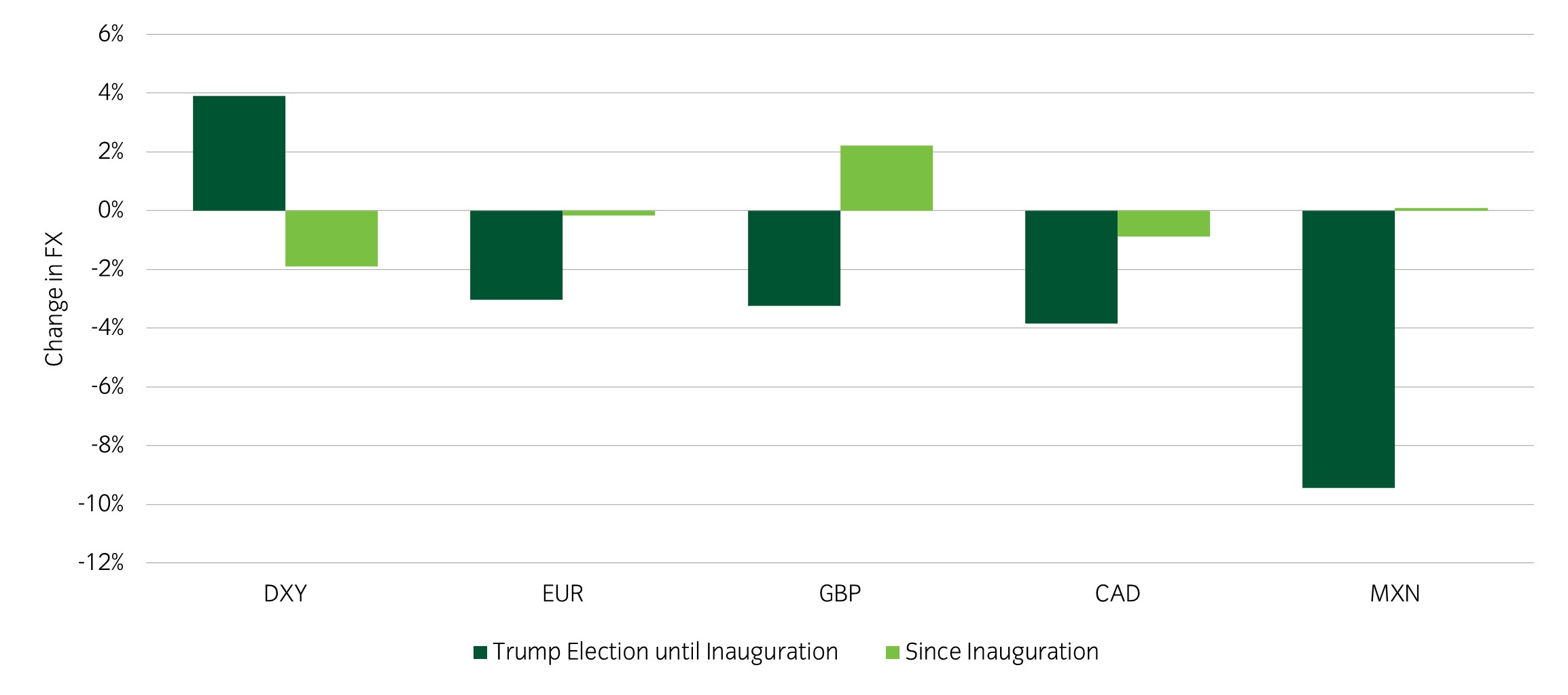

FX moves have moderated since Trump’s inauguration

Source: Insight and Bloomberg as at 27 February 2025.

- Since Trump was elected in November 2024, the FX market had begun to price in impacts from his potential policies. The dollar rallied between the election and Trump’s inauguration in January 2025 but has weakened since. Currencies such as the Mexican peso and euro have depreciated between the election and the inauguration, but have moderated since then.

- The moderation witnessed in FX markets since Trump’s inauguration probably results from the consistency of his tariff announcements with his previous comments, meaning announcements are largely in line with market expectations. Furthermore, some recent US growth data has negatively surprised participants.

- Within our portfolios, we have long USD exposure but remain wary of the possibility that fears around Trump policies such as tariffs have largely been priced in since his election in November.

Chart of the week

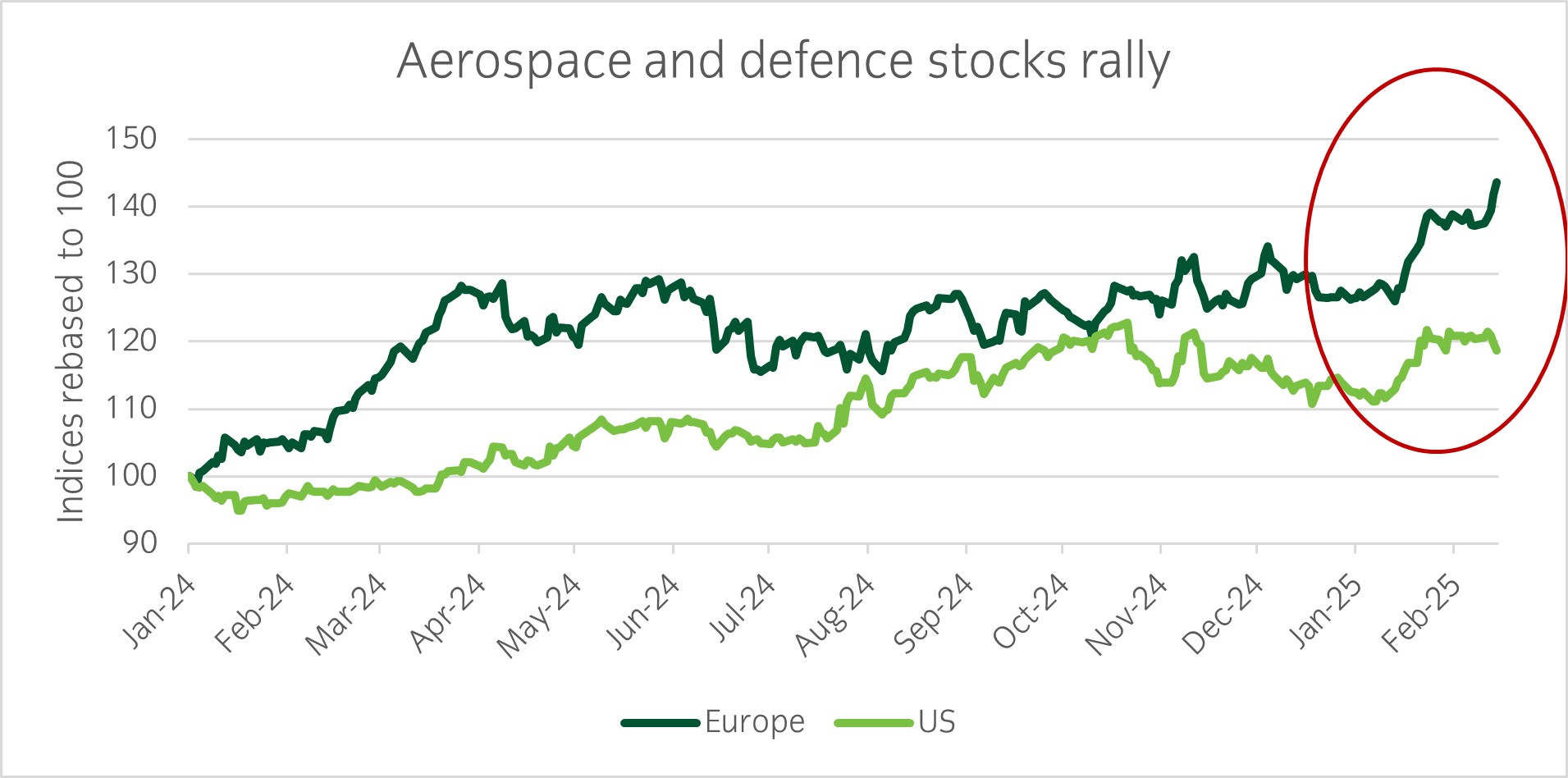

The US is increasing pressure on Europe to increase defence spending

Source: Bloomberg and Insight Investment as at 14 Feb 2025.

- Over the weekend, US Vice President JD Vance explicitly called on European countries to increase defence spending and to contribute more to protecting Ukraine

- European defence stocks have continued their recent rally which began around the start of Donald Trump’s presidency

- US defence companies may also benefit from any increase in European governments’ defence spending.

Significant market moves this week

Source: Bloomberg and Insight as at 21 February 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: Chinese and MSCI emerging market equities performed well, while the USD was generally weak following a strong run.

Over the past week, several things caught our eye:

- Chinese equities extended their recent rally, driven largely by optimism in the technology sector. Alibaba, which is one of the largest Chinese stocks, reported better-than-expected revenue on Thursday and announced increased AI development. This boosted its stock price by 9%.

- Also on Thursday, US retail sales data showed a sharp contraction, making the largest monthly decline since March 2023. This, coupled with a weaker-than-expected forecast from Walmart, raised some concerns about US consumer spending. As a result, US equities softened but remain close to all-time highs.

- The German election is taking place this weekend. According to Politico’s polling data, the conservative CDU/CSU block is leading with 30%, while the far right AfD holds 21% and the central left SPD stands at 16%. The outcome is in focus as Germany is likely to change its policy on its ‘debt brake’ to fund any increased spending on defence.

Asset allocation observation

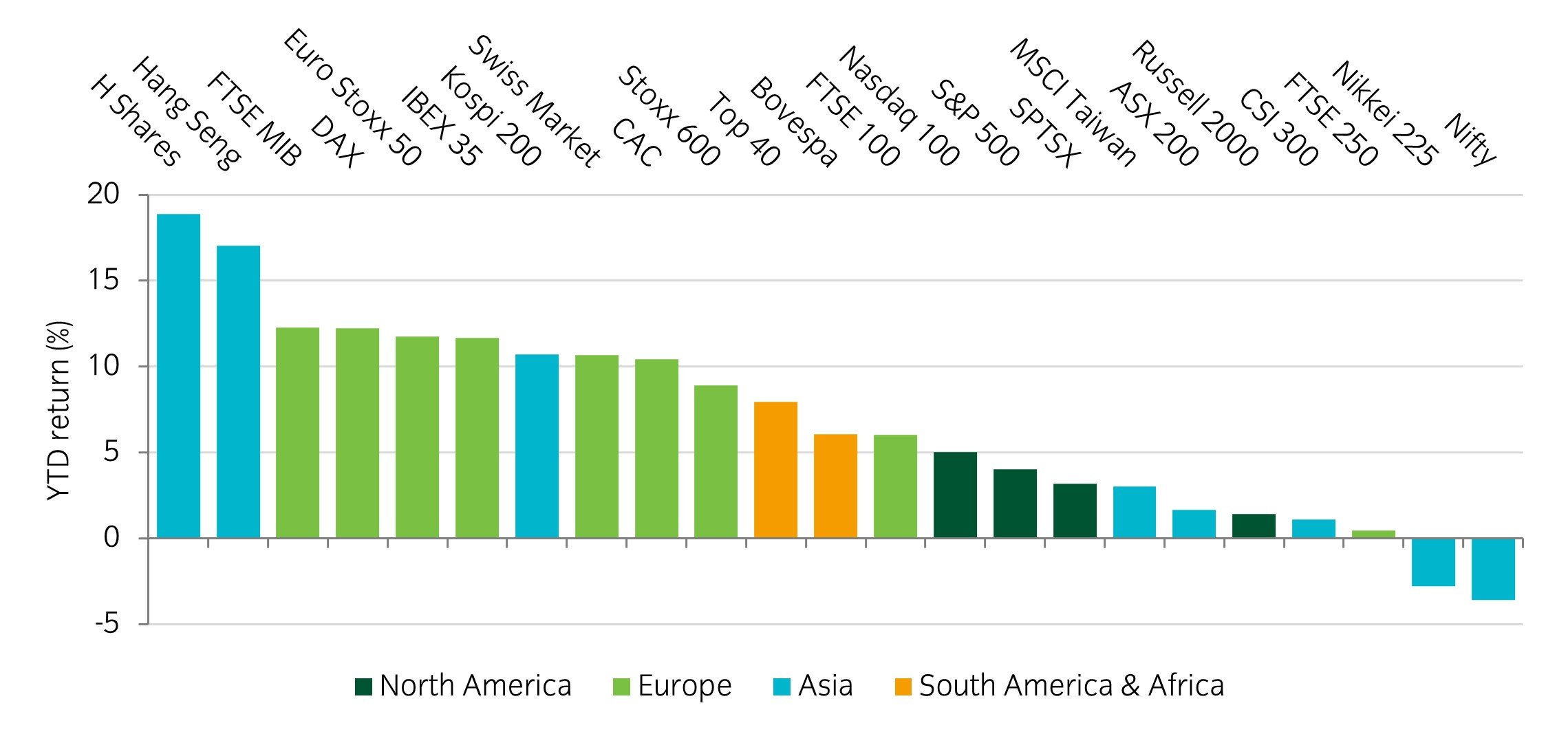

China and Europe lead 2025 equity returns

Source: Insight and Bloomberg as at 21 February 2025.

- Europe and China, two largely under owned markets coming into 2025, have enjoyed an incredibly strong start to the year. Chinese equities have been given an AI-related boost with H Shares up 20% since the release of DeepSeek R1. In Europe, the bounce can be largely attributed to the likely end of conflict in Ukraine and a lack of concrete tariff action, but market technicals had left these indices ripe for a squeeze higher.

- Within our portfolios, we have added tactical upside positions to both these markets. While the longer-term outlook remains challenged, years of underperformance relative to the US could provide further support as investors reallocate.

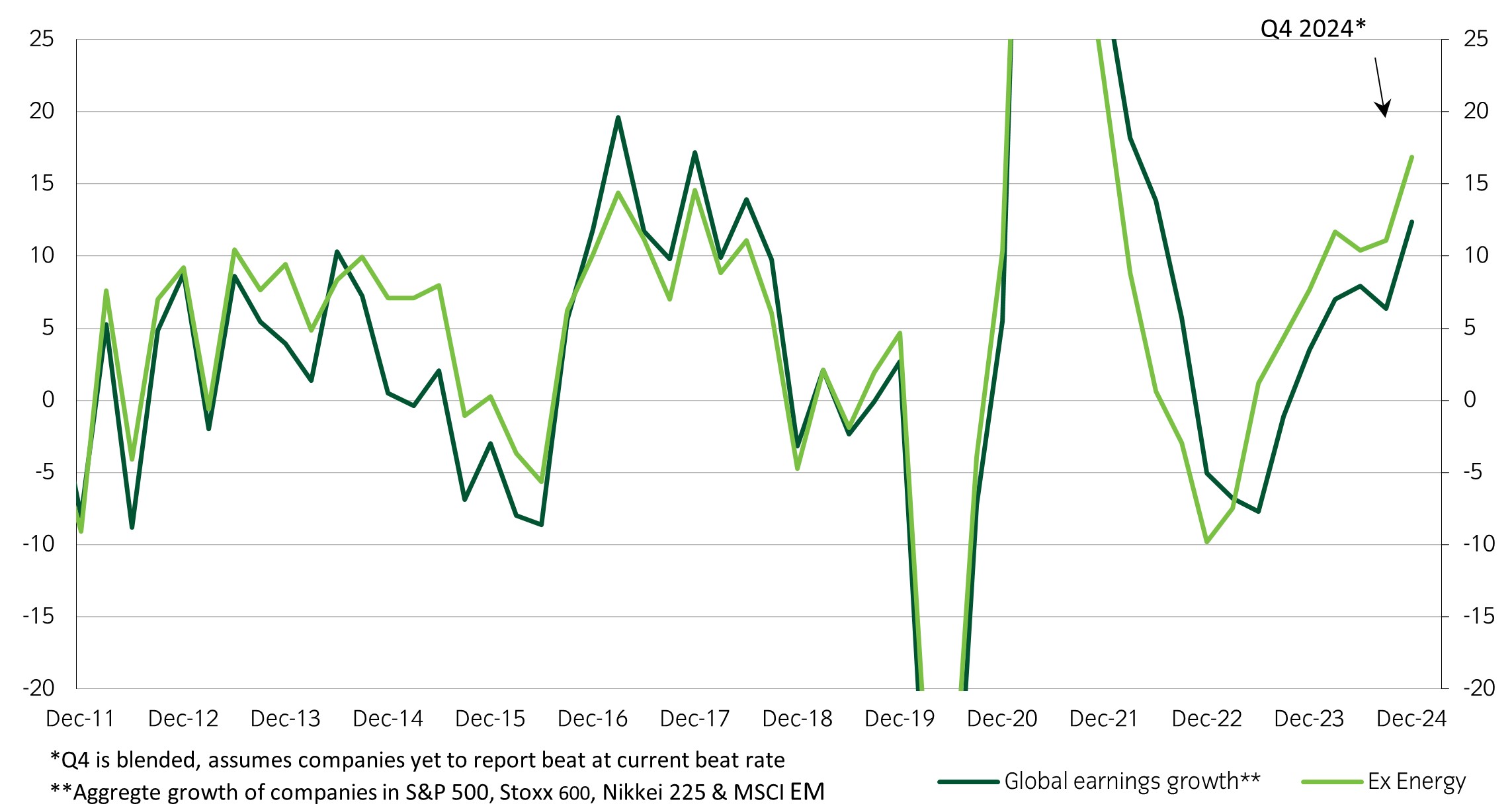

Chart of the week

Global earnings growth continues its uptrend

Source: Deutsche Bank, as at 14 February 2025.

- This week, markets have continued to focus on earnings announcements and potential new tariffs imposed by the Trump administration. Equity markets have generally trended up, as earnings continue to surprise positively (69% of companies have beat their estimates), and specific details around Trump tariffs have seemingly been delayed until April.

- Geopolitics also played a role this week, as speculation around a potential ceasefire in the war between Russia and Ukraine increased. Presidents Trump and Putin had a constructive discussion. Furthermore, some more details of a potential ceasefire may come out of the Munich Security Conference taking place this weekend. These developments have boosted sentiment, especially for European assets this week.

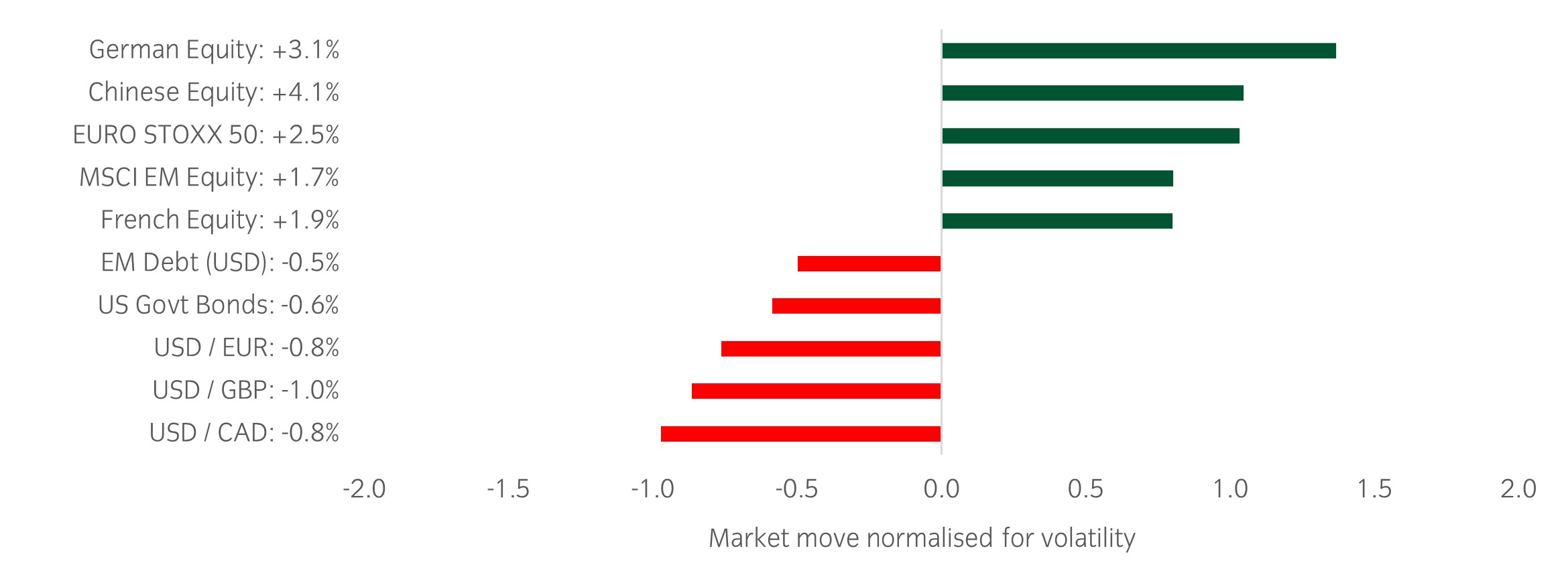

Significant market moves this week

Source: Bloomberg and Insight as at 14 February 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: European and Chinese equities had strong performances, while the USD weakened against other developed market currencies

Over the past week, several things caught our eye:

- US CPI surprised to the upside relative to expectations (3.0% YoY actual vs 2.9% YoY expected) – this led the market to price push out cuts from the Fed until the end of 2025

- Chinese equities rallied strongly, driven largely by optimism in Chinese AI technology companies

- US retail sales surprised negatively, the largest monthly decline in two years, in part due to recent wildfires and storms in the US. This has led to US yields and USD falling amid concerns around continued growth in the US.

Asset allocation observation

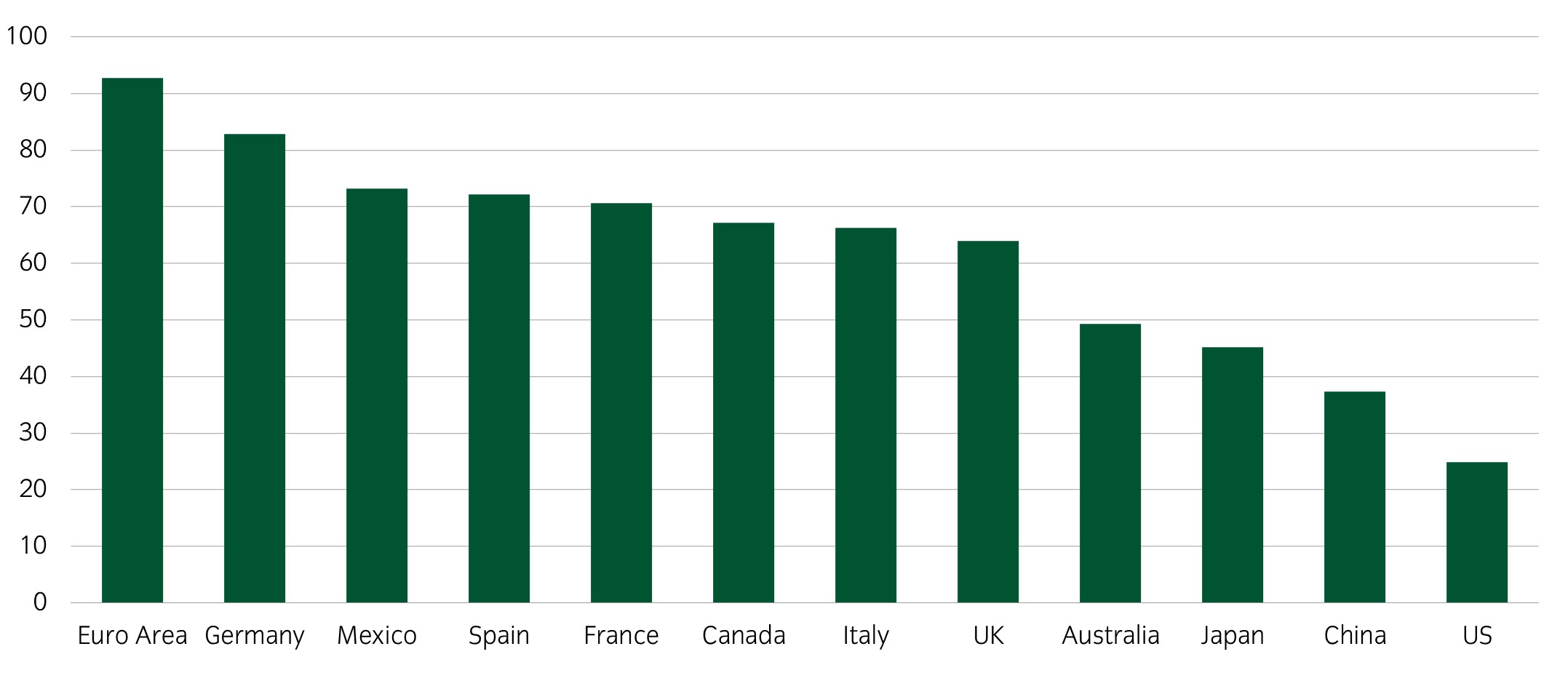

Europe, Mexico, Canada in the crosshairs

Source: Insight and Bloomberg as at 14 February 2025.

- Trump has so far focused on tariffs for Mexico, Canada and China, but likely will announce tariffs on the European Union. Trade as a percentage of GDP for these countries is relatively high, and the Trump administration perceives tariffs as one way to ‘level the playing field’ in favour of the US.

- The exact impact on growth and inflation both in the US and other countries will depend on the magnitude of tariffs and the type of implementation. However, the direction of travel (toward more protectionist policies) remains clear.

- European equities continued their strong start to the year, as the announced tariff measures have generally aligned with expectations. The portfolio holds tactical positions that should benefit from a continued bounce in European assets.

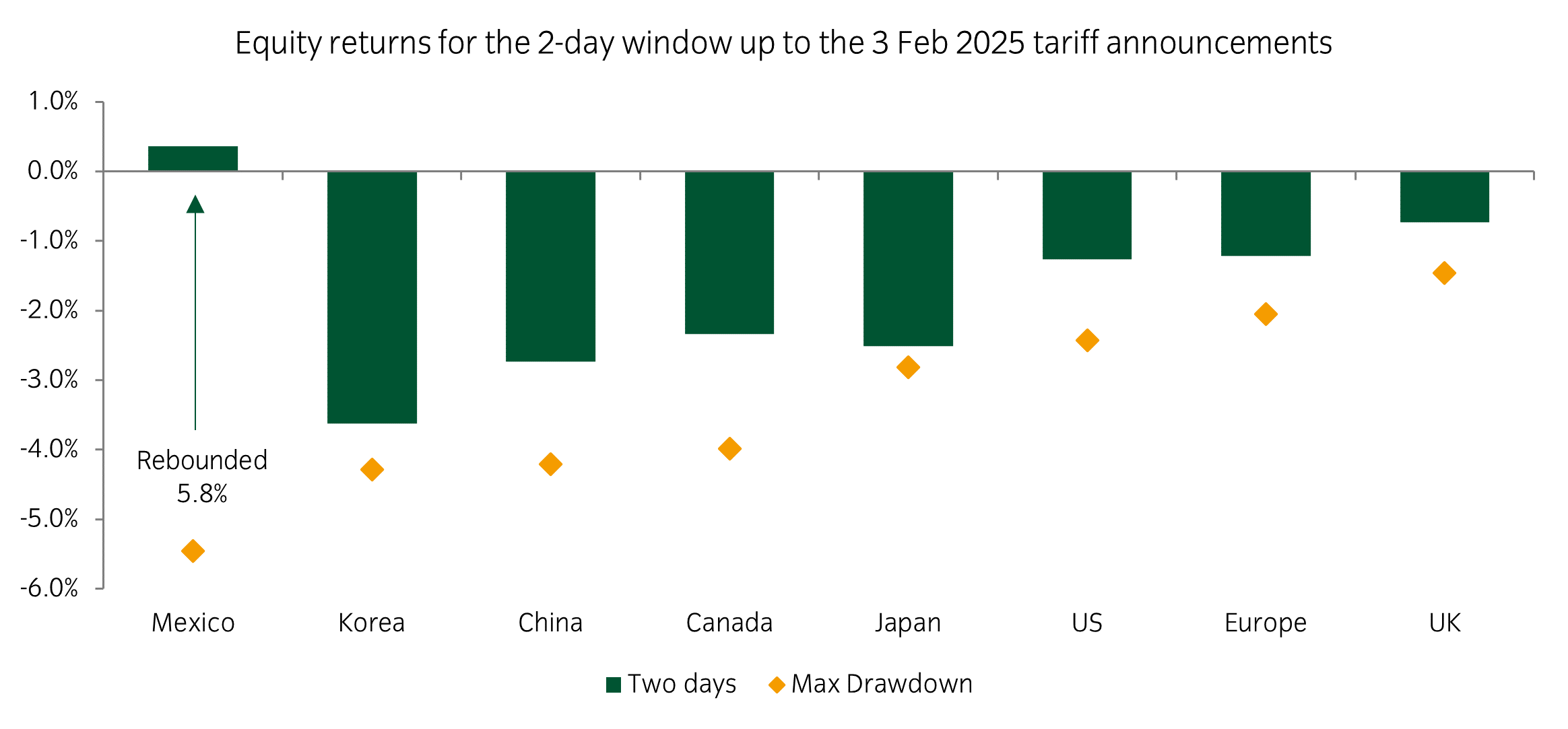

Chart of the week

Equity markets retrace after tariff reaction

1The time frame referred to covers trading from end of day Thursday 30 January to end of day Monday 3rd February.

Source: Insight Investment and Bloomberg as at 07 February 2025.

- Last Friday, a sell off started as markets reacted to rumours of US Tariffs on Mexico and Canada. Over the weekend, Trump confirmed 25% tariffs on Mexico and Canda, and 10% on China. By early afternoon on Monday, Mexican equities were down 5.5%. and Canadian and Chinese equities were down 4.0% and 4.2% over the two days.

- By Monday lunchtime, negotiations led to a 30-day pause for Mexico and Canada. China then announced limited retaliation measures. Mexican equities rebounded by 5.8%, while Canadian and Chinese equities also partially recovered.

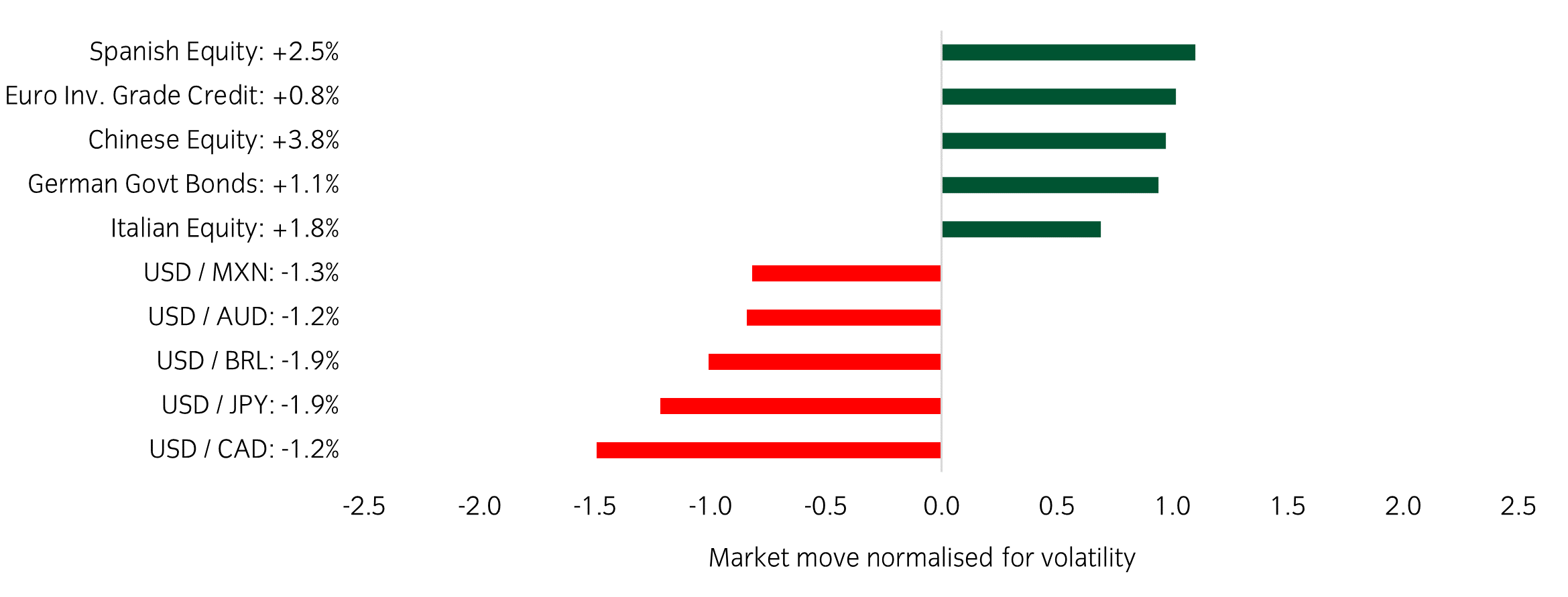

Significant market moves this week

Source: Bloomberg and Insight as at 07 February 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: European equities continued their strong start to the year while the US dollar weakened following tariff postponements.

Over the past week, several things caught our eye:

- The US economy added 143k jobs in January, below estimates of 175k. Most importantly for the market average hourly earnings rose +0.5% month on month, moving the year-on-year number up from 3.9% to 4.1%.

- Two more of the Magnificent 7 reported this week, but the price reaction to both Alphabet and Amazon was negative. Alphabet traded down 7% following a miss on revenue and a revision higher to Capex expectations. Meanwhile, Amazon delivered solid Q4 earnings weaker Q1 guidance left the stock down 4% after hours.

- The Bank of England cut its deposit rate by 25bp to 4.5%, although it was changes to its economic forecasts that grabbed headlines. Its growth forecast for 2025 was halved to 0.75%, while inflation expectations were revised higher from 2.8% to 3.7%.

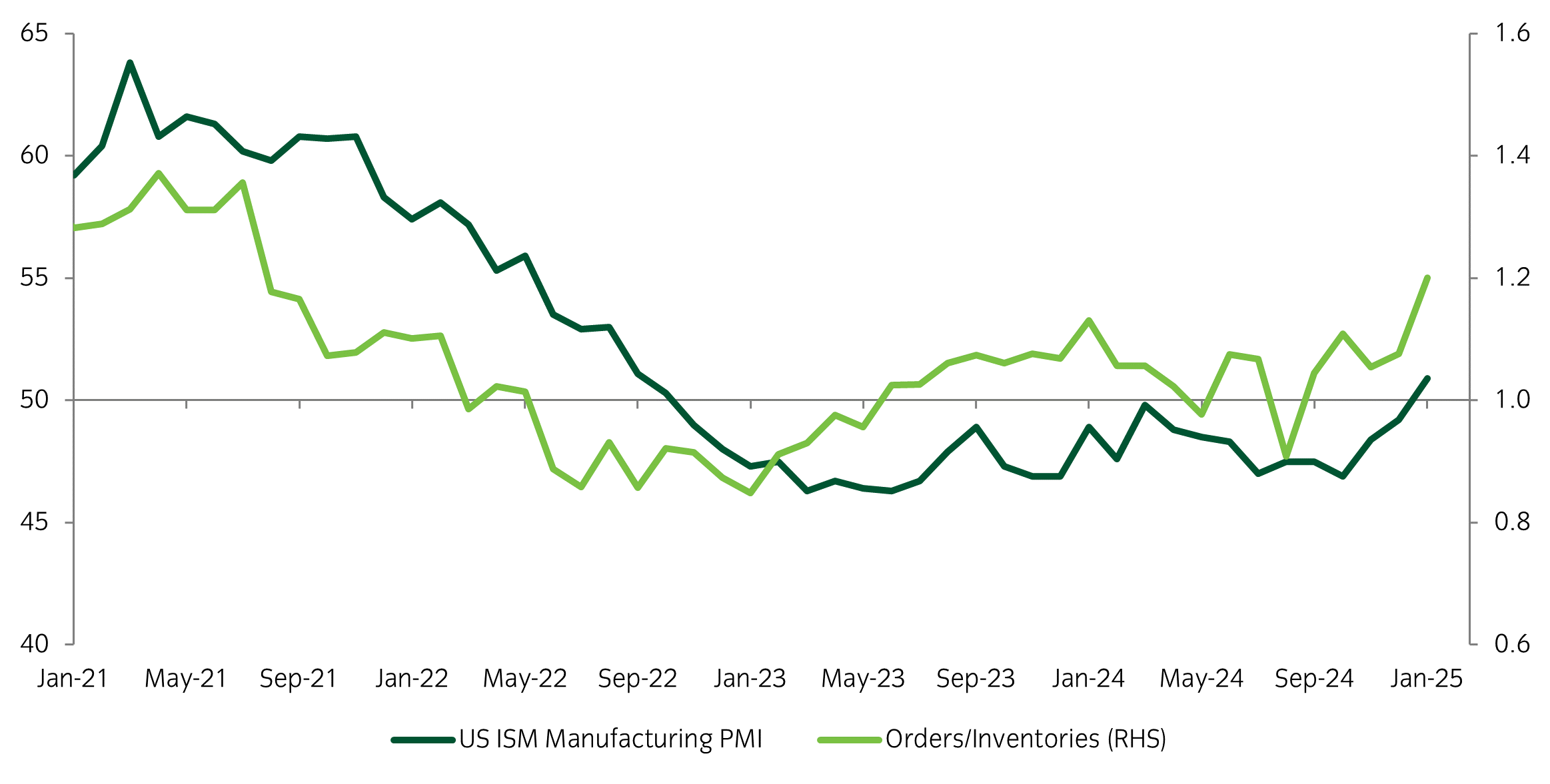

Asset allocation observation

ISM manufacturing PMI continues rebound

Source: Insight and Bloomberg as at 07 February 2025.

- The US manufacturing ISM moved into expansion territory in January for the first time since October 2022 and the 4-point jump in the index on a 3-month view is the sharpest rise of all of the countries we monitor. The underlying mix was positive with the rise being driven by an increase in the new orders and production diffusion indices. The ratio of new orders to inventories, which can be a useful forward-looking indicator, had been signalling a recovery since September.

- Viewed through the lens of our macro regime framework, we see global growth data remains consistent with a ‘stabilising’ growth regime. The change in global manufacturing PMI is positive on a 3-month view, and most country/regional PMIs are improving over the same period.

Chart of the week

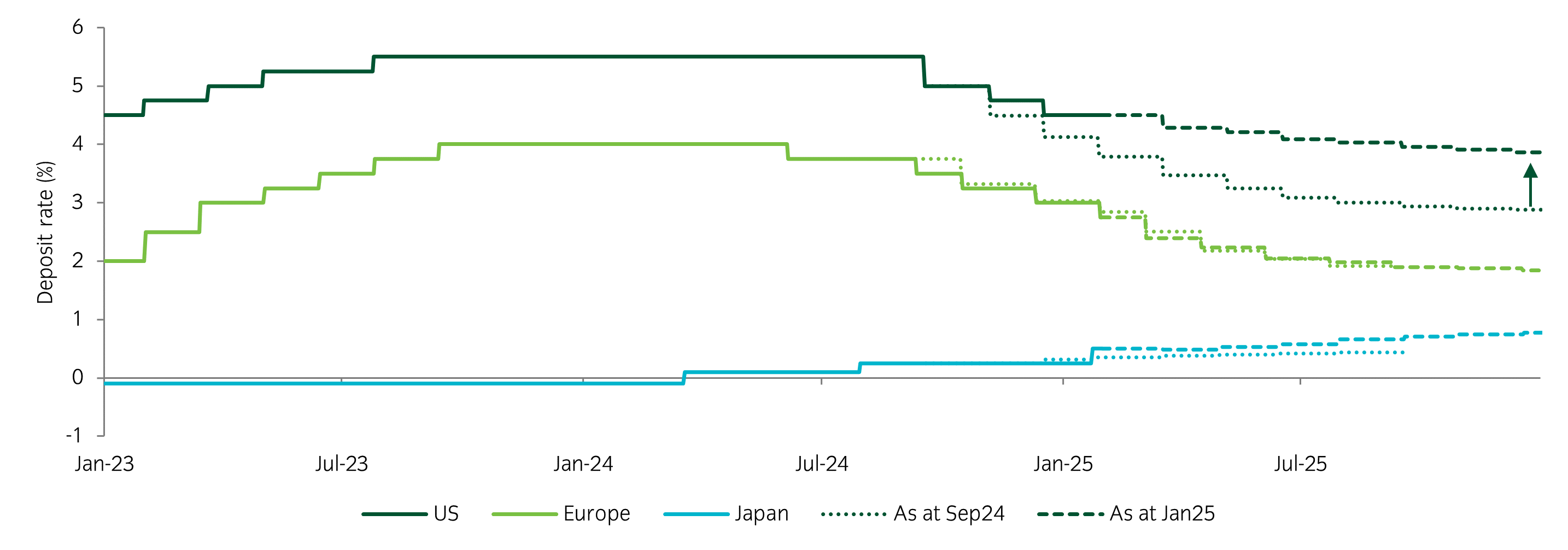

Central Bank expectations for 2025

Source: Insight Investment and Bloomberg as at 31 January 2025.

- Market expectations for US and European central bank rate cuts had tempered somewhat over the past quarter. This is most notable in the US, where uncertain policy & inflation risks have pushed the markets into adopting a wait-and-see mindset.

- Conversely, the Bank of Japan (BoJ), which ended its longstanding Negative Interest Rate Policy (NIRP) in 2024, is now expected to end 2025 with a rate of 0.75%. Notably, this would mark the BoJ’s highest rate since 1995.

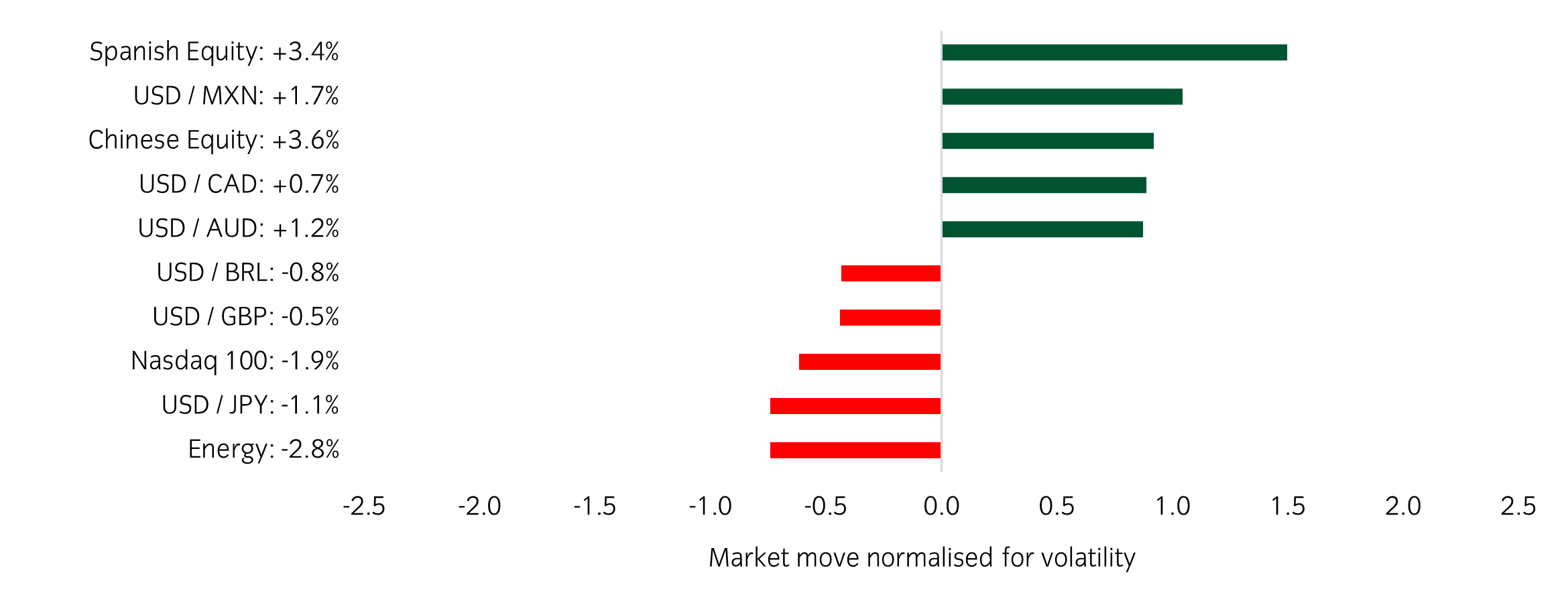

Significant market moves this week

Source: Bloomberg and Insight as at 31 January 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: European equities performed well on the week, while markets with a heavy link to semiconductors and AI, such as the Nasdaq, struggled.

Over the past week, several things caught our eye:

- The AI narrative was thrown a curveball this week, as the release of DeepSeek R1 has led many to question both Nvidia’s competitive moat and the current levels of CapEx from the Megacap tech stocks. Nvidia lost a record $589bn in market cap (-17%) on Monday but has since stabilised.

- The Federal Open Market Committee (FOMC) and European Central Bank (ECB) held meetings this week, with both events passing without incident. The FOMC kept rates unchanged, maintaining its stance that the economy remains in a good place, but policy is still in restrictive territory. The ECB opted for a 25bp cut, bringing the overall rate to 2.75%.

- The Euro Stoxx 50 is on track for an 8.5% return in January which would mark its second-best start to a year ever. This can likely be attributed to low positioning and the focus of US tariffs currently being directed towards other markets (namely Mexico and Canada).

Asset allocation observation

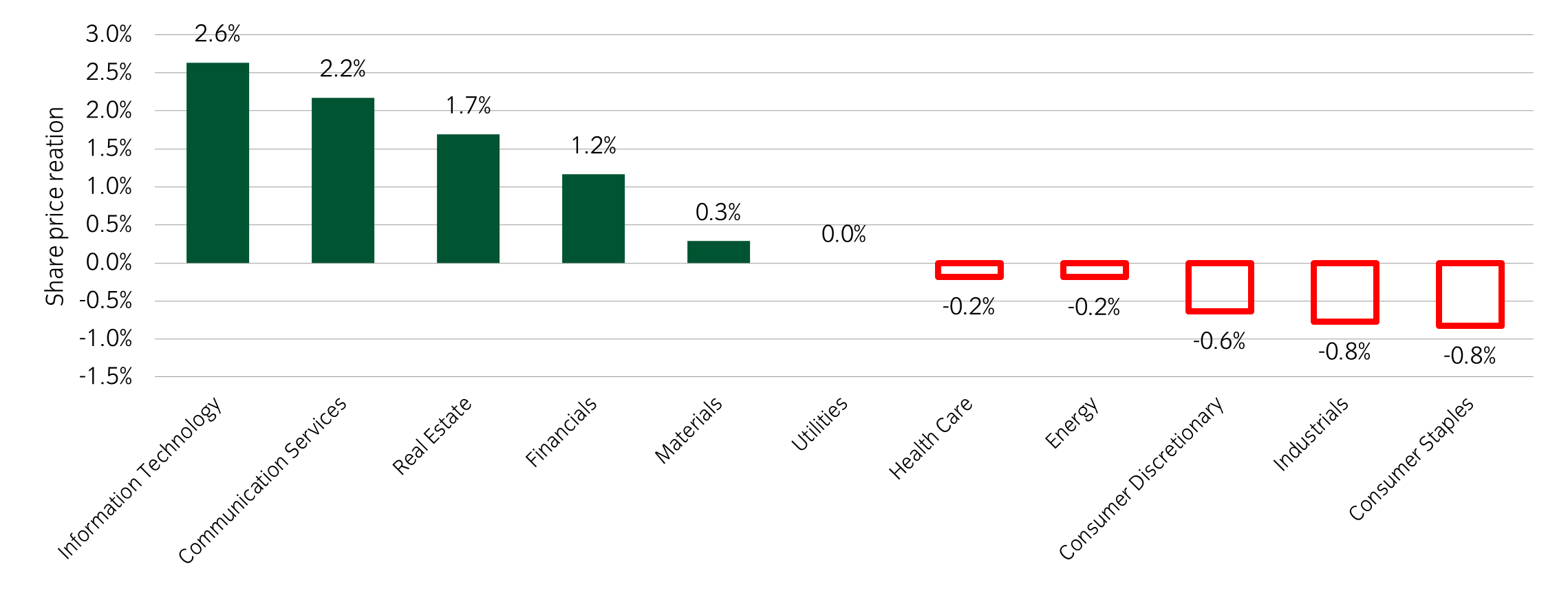

Technology is still being rewarded on earnings

Source: Insight and Bloomberg as at 31 January 2025.

- While the Deepseek developments caused some of the largest moves for technology stocks, earnings reports this week were also an important driver. Almost 50% of S&P 500 companies have now reported, and generally earnings have been strong, with the percentage of companies beating expectations now at 80% and the EPS growth rate looking like it could push through double digits.

- Our chart this week shows that it is still technology names that are being rewarded the most in terms of share price reaction. The average share price reaction for technology sector and communication services sector (containing internet names like Meta) was above 2%. Financials have also had a strong earnings season, while staples and industrials have lagged thus far.

Most read

Multi-asset

March 2025

Multi asset chart of the week

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Australia

Australia