Chart of the week

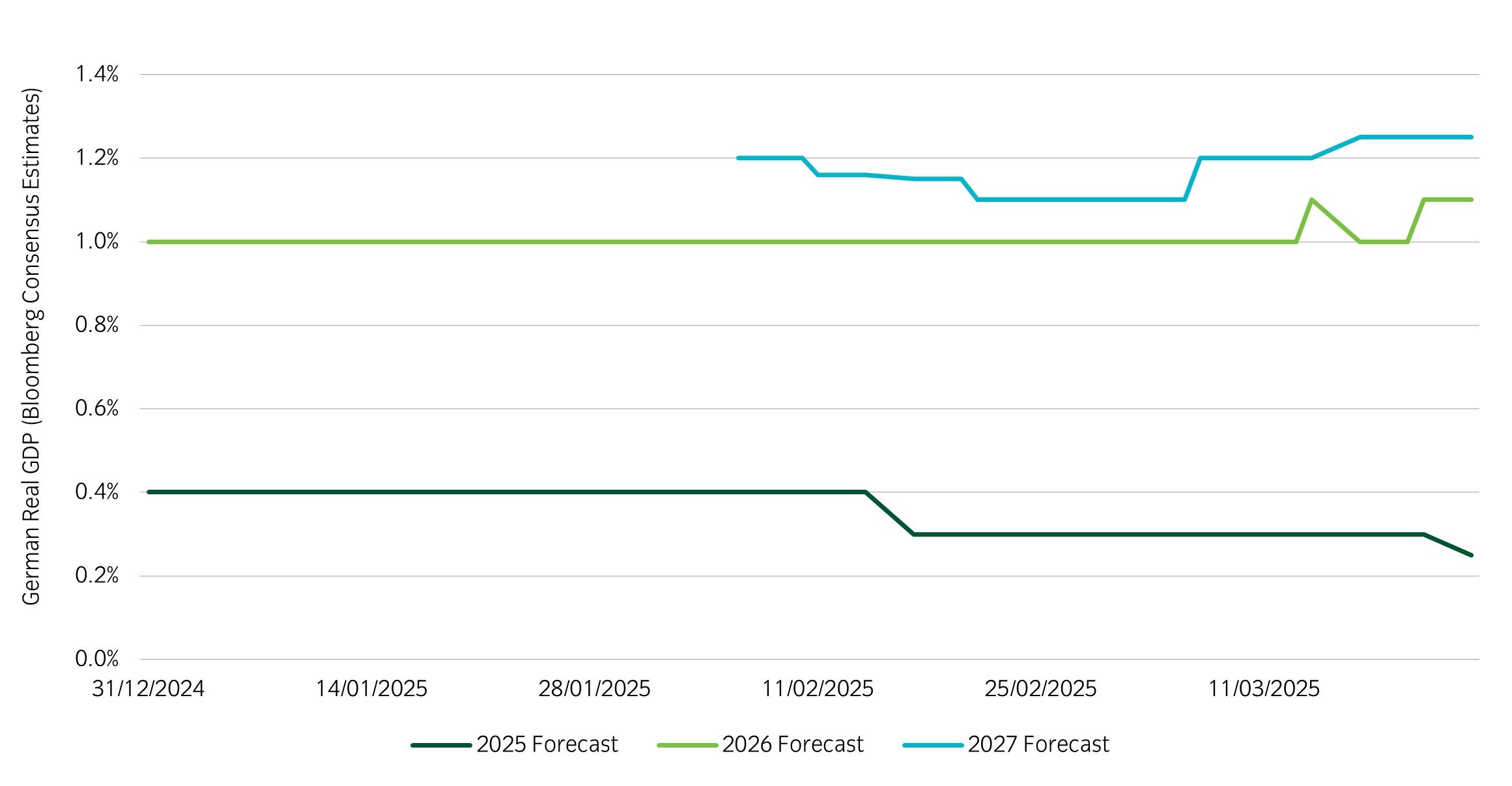

Upward revisions for German growth forecasts

Source: Bloomberg and Insight Investment as at 24 Mar 2025.

- In recent weeks, economists across Wall Street have upwardly revised expectations for German real GDP growth in 2026 and 2027.

- The more optimistic growth projections are a result of new fiscal stimulus– the German Parliament recently passed legislation approving increased deficit spending. This is an historic change as for many years German fiscal policy favoured a balanced fiscal budget rather than deficit spending.

- Growth estimates for 2025 moderated as estimates for 2026 and 2027 improved, as it will likely take time for the impact of expansionary fiscal policy to feed through into hard economic data.

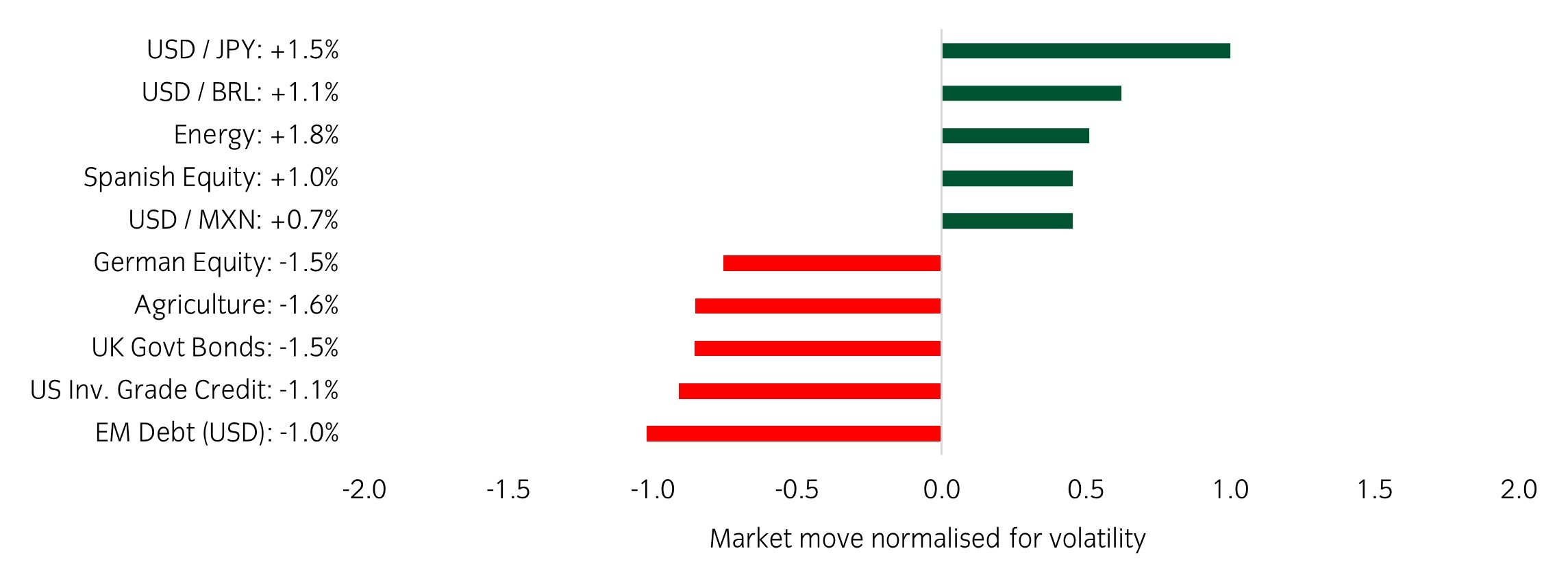

Significant market moves this week

Source: Bloomberg and Insight as at 27 March 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: USD gained vs JPY and LATAM FX, while emerging market debt and US investment grade credit lost.

Over the past week, several things caught our eye:

- President Trump announced 25% tariffs on imported cars and car parts as part of his effort to boost US manufacturing and to reduce the US trade deficit. Some of the largest exporters of cars or car parts to the US include Mexico, South Korea, Japan, Canada, and Germany. These countries’ currencies weakened following the tariff announcement, but the magnitude of the moves has been relatively muted. Shares of automakers in Europe and the US also declined in response.

- Market participants continue to wait for the so-called US ‘Liberation Day’, the 2nd of April, for greater detail of Trump’s tariffs. Whether the tariffs target specific regions or types of imports, the magnitude of the tariffs, and the type of implementation (for example, reciprocal or not), will ultimately determine the impact on both the US and its trades partners.

- In the UK, gilt yields rose after the UK Chancellor Rachel Reeves delivered the government’s spring statement to parliament. This outlined plans for welfare spending cuts and increases to defence spending. Growth forecasts for 2025 were reduced from 2% to 1%, but growth forecasts for 2026 and beyond were increased. The subsequent market reaction might reflect a fear that the spring statement marked the extent of good news, and that economic uncertainty will pick up as the year progresses.

- Flash PMIs were released this week – the manufacturing PMI improved for the Euro Area over one and three months, but the manufacturing PMI declined for Japan and the UK over one and three months. This reflects some regional economic divergence amongst developed markets.

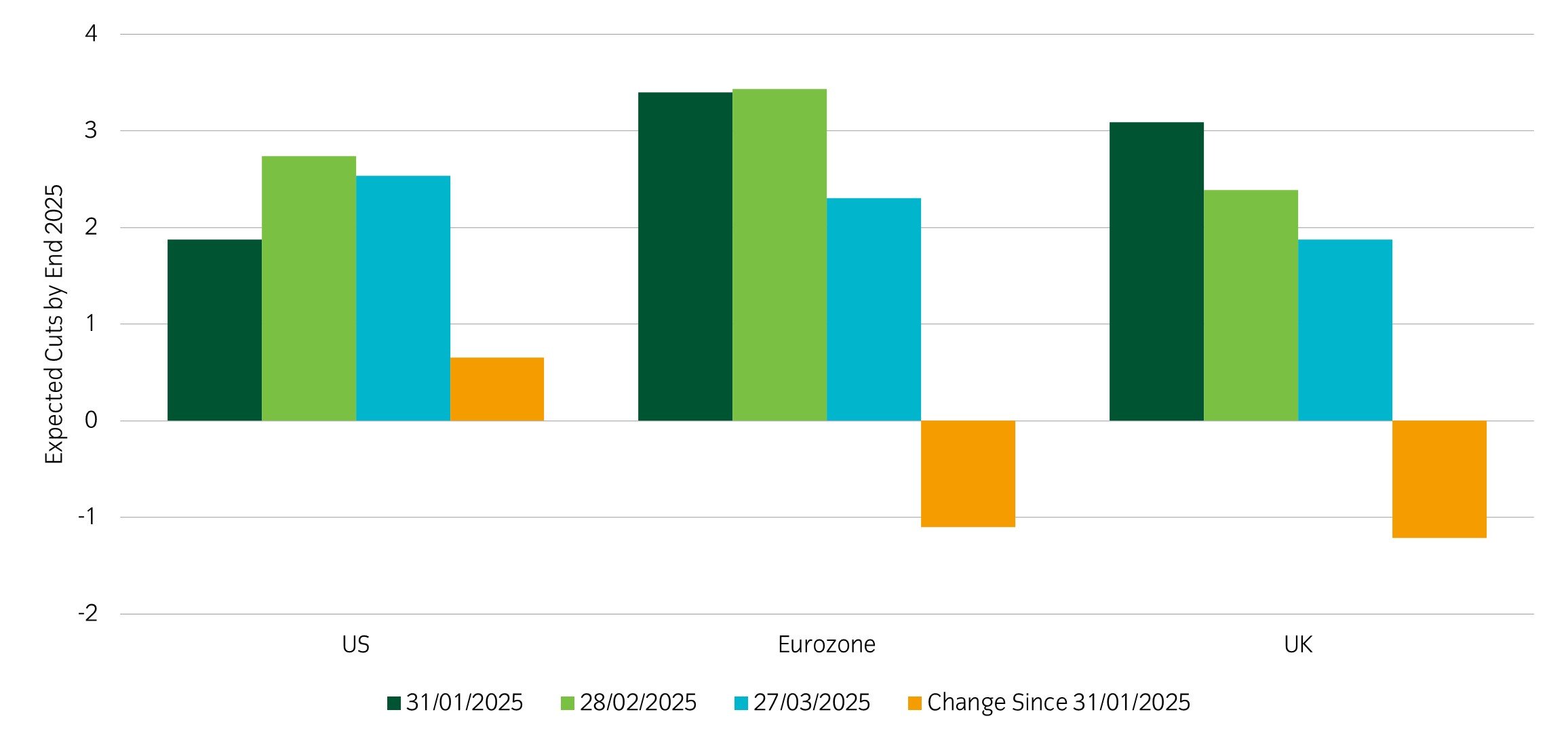

Asset allocation observation

Shifts in expected monetary policy

Source: Insight and Bloomberg as at 27 Mar 2025.

- In recent weeks, the market has shifted its expectations of monetary policy changes from the Federal Reserve, Bank of England (BoE|), and European Central Bank (ECB). These shifts reflect diverging macro backdrops and potential policy directions between the US and Europe. At the beginning of 2025, more cuts were expected from the ECB and BOE compared to the Fed. Currently, however, the market has increased expectations for rate cuts in the US and decreased its expectations for rate cuts in the UK and Europe.

- For the US, markets are pricing in growth and policy uncertainty given the ambiguous impacts of Trump’s tariff policy. For Europe, markets have priced in fewer rate cuts, as Germany and other European countries expand fiscal spending, which may keep growth and inflation supported. For the UK, stubbornly high inflation (above the B0E’s 2% inflation target) has also led to expectations of fewer rate cuts.

- Within our portfolios, we have a relative value position that is long UK gilts and short German bunds. This position will benefit if policy divergence materialises, and UK bond yields decline more than German bund yields.

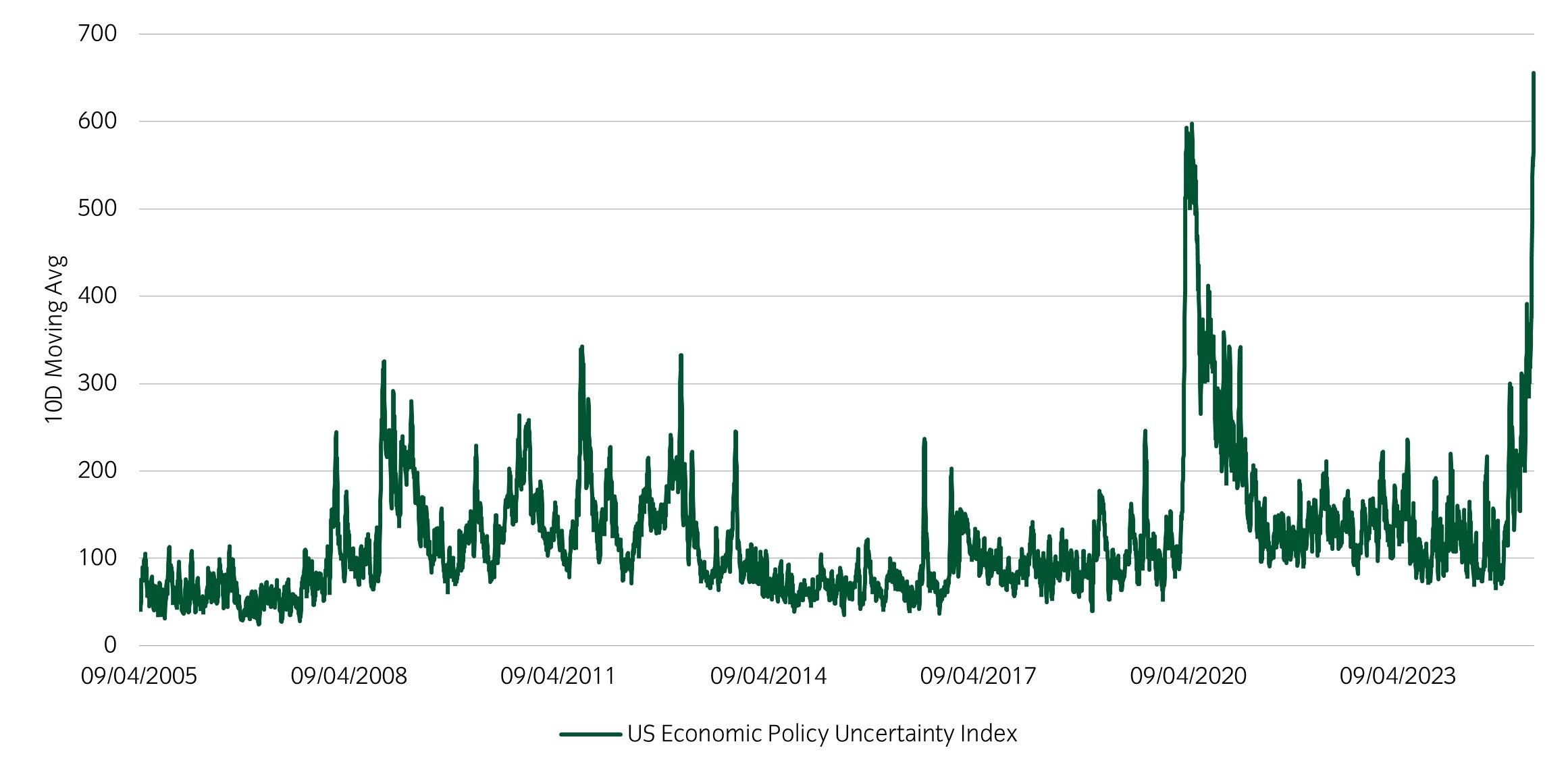

Chart of the week

US economic policy uncertainty at historical high

Source: Bloomberg and Insight Investment as at 16 Mar 2025.

- The US economic policy uncertainty index has reached highs not seen since the COVID pandemic in 2020.

- The uncertainty is likely related to new tariffs, both actual and threatened, placed by the US on trade partners such as Canada, Mexico, Europe, and China. These countries and regions have also planned retaliatory measures against the US. Furthermore, there is uncertainty around US domestic fiscal policy and the Fed’s monetary policy. The specific path forward for both fiscal and monetary policy will depend on the trajectory of US growth and inflation.

- Markets, in turn, are experiencing a pullback as they digest headlines around tariffs and consider the broad implications on trade and global growth.

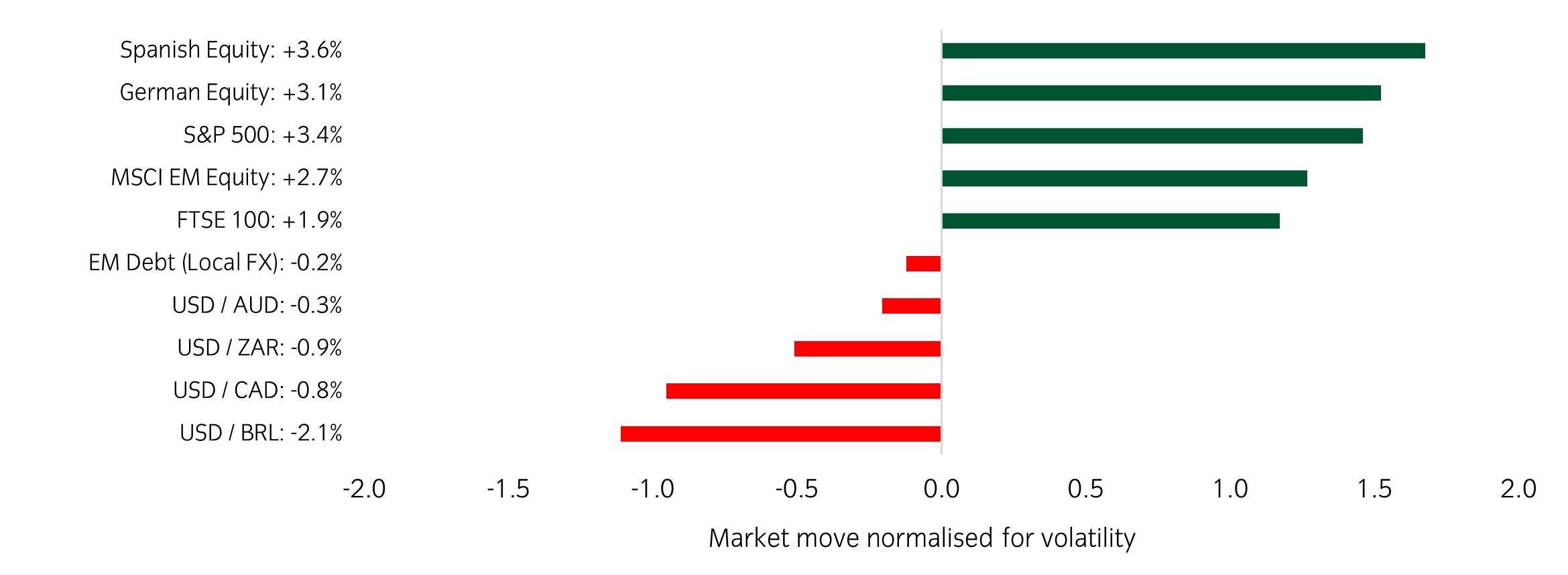

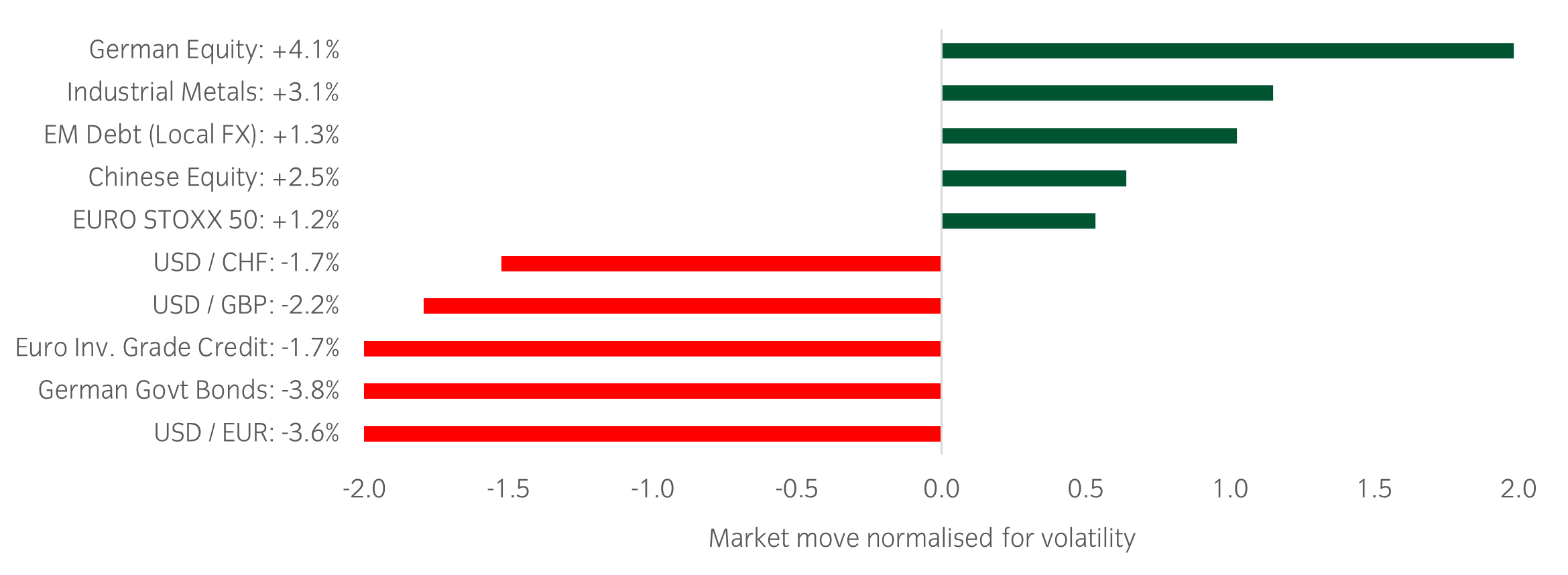

Significant market moves this week

Source: Bloomberg and Insight as at 20 March 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: European and Chinese equity made large gains while the USD broadly weakened.

Over the past week, several things caught our eye:

- European equities, especially German equities, rallied as the German parliament moved toward increased fiscal spending and changes to the debt brake. The parliament agreed to a €500bn infrastructure fund and more fiscal space for state government spending. This is a historic change in fiscal rules for Germany and will likely have implications for broader fiscal loosening across Europe. Defence spending has become a priority for Germany as the US reduces its support for NATO and Europe.

- The Russia and Ukraine war continues to be in the headlines – peace talks, brokered by the UK and the US, for a potential ceasefire are taking place. Specific conditions for a ceasefire remain in discussion. Ultimately, a ceasefire would have implications on sentiment and growth in the region.

- The US 10-year yield fell after the latest Federal Open Market Committee (FOMC) policy meeting. The Federal Reserve (the Fed) maintained its policy rate, while changing its growth and inflation outlooks for the coming years. It reduced its growth projections, while upwardly revising its inflation projections for 2025. The Fed also acknowledged its data dependence for upcoming policy changes.

Asset allocation observation

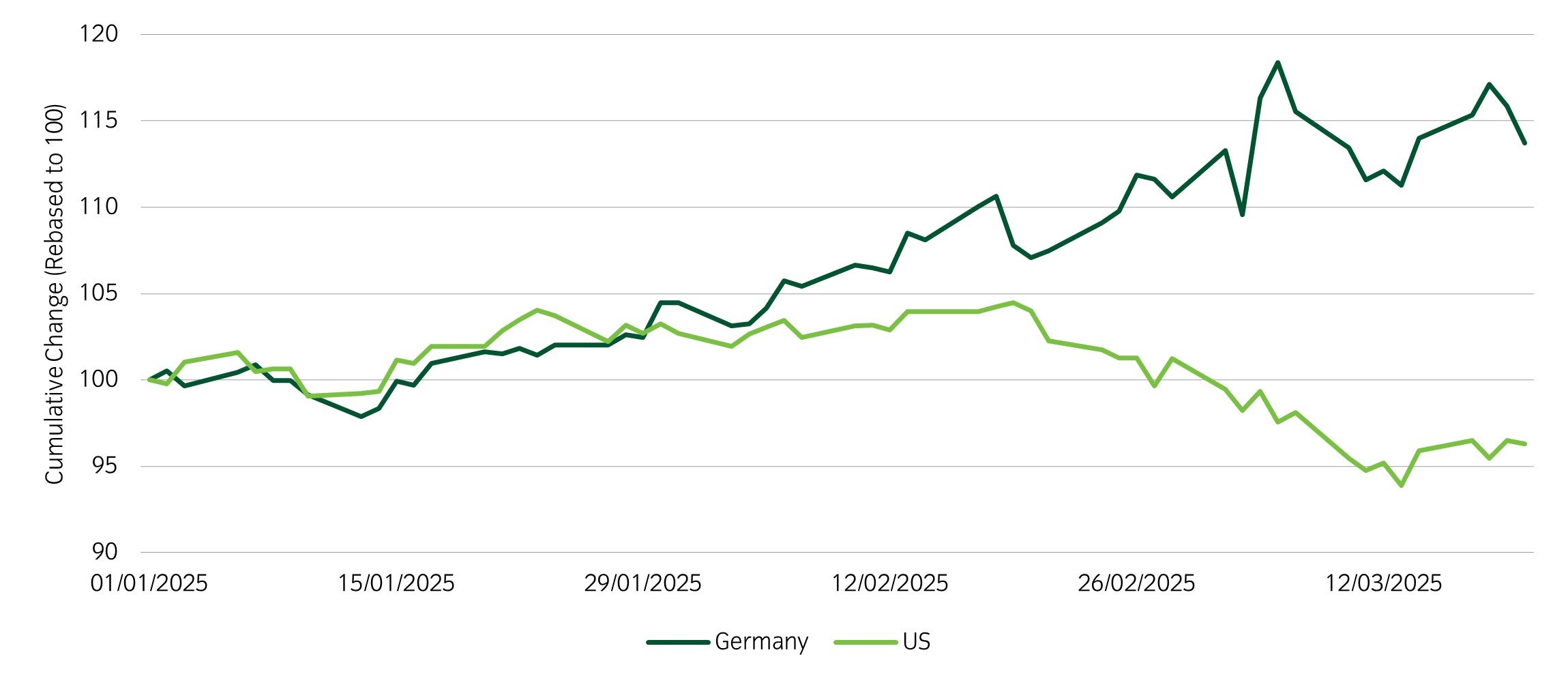

German equities outperform US equities

Source: Insight and Bloomberg as at 20 Mar 2025.

- From the beginning of 2025, European equities (and specifically German equities) have outperformed US equities. This relative outperformance may be due to several factors. Firstly, the narrative around European growth prospects had been quite negative coming into 2025, but some of the economic growth data such as PMIs have been improving since the start of the year, albeit from a lower base compared to the US.

- Furthermore, European equities have been surging due to expectations of increased European fiscal spend as the US decreases its support of European defence. The German government is nearing a historic shift toward deficit spending that would likely boost investment and growth across the region.

- Within our portfolios, we have a relative value position that is long German equities and short US equities. This position will benefit if German equities continue their year-to-date outperformance of US equities.

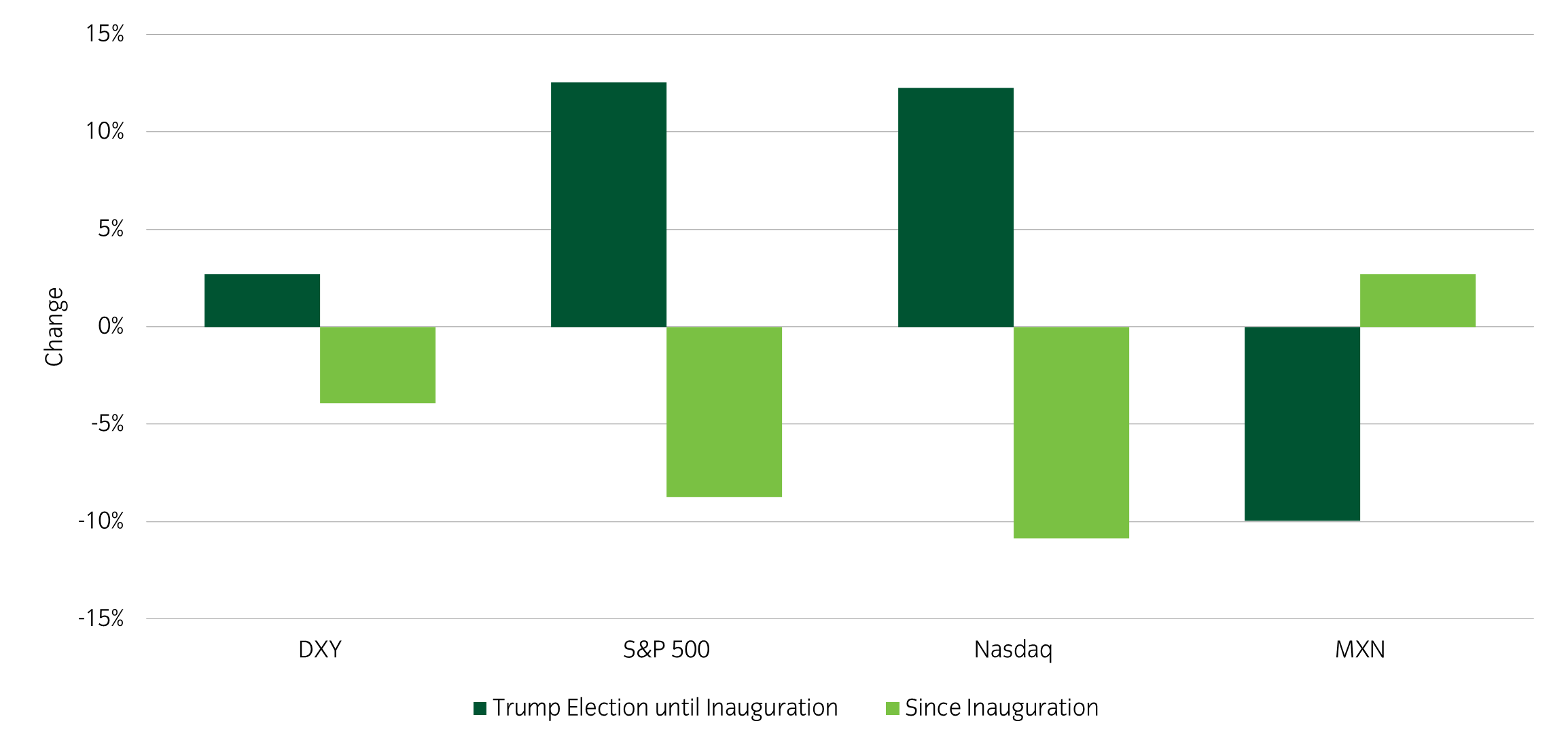

Chart of the week

Reversal of popular Trump trades since his inauguration

Source: Bloomberg and Insight Investment as at 13 March 2025

- Popular Trump trades – especially those associated with US exceptionalism – reversed their gains in recent weeks. The US dollar and US equities had rallied from the time of Trump’s election until his inauguration.

- Since Trump’s inauguration, uncertainty around tariffs and US policy has coincided with a reversal in the US dollar and US equity performance.

- Markets experienced a broad drawdown over the week as they attempted to digest headlines around tariffs and their implications on policy.

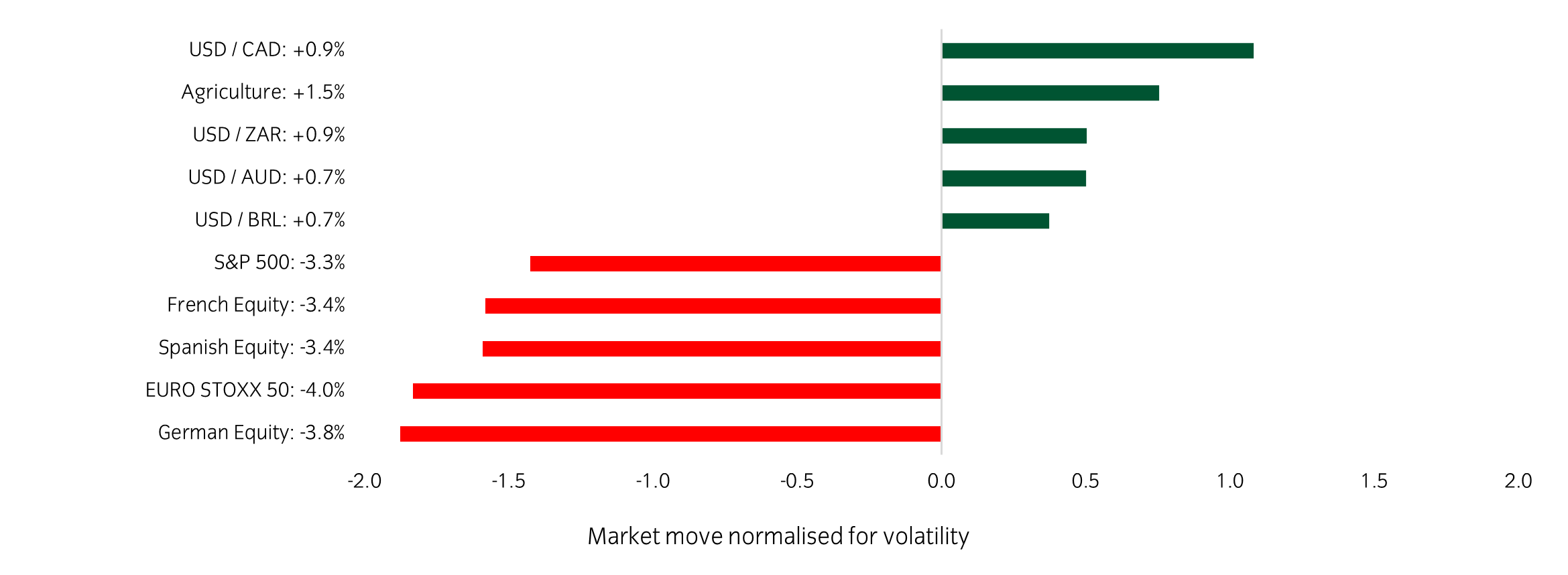

Significant market moves this week

Source: Bloomberg and Insight as at 13 March 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: The USD made small gains against some currency pairs, but US and European equities suffered relatively large drawdowns.

Over the past week, several things caught our eye:

- US equities, especially tech-related stocks, were hit hard. Assets that were previously expected to do well with Trump’s protectionist agenda suffered a reversal, as markets aimed to digest volleys from the trade war. Tensions escalated as trade partners announced various countermeasures against the US.

- While equities suffered a pullback, bonds did not act like a traditional diversifier as yields remained relatively flat. The ultimate impact on the direction of global bond yields remains to be seen, but Europe will likely expand fiscal and defence spending, which may boost growth and inflation. However, new tariffs may dampen growth and spur inflation.

- The Russia and Ukraine war continues to be in the headlines – there seems to be potential for a ceasefire brokered by the US. However, the specific details and conditions around a ceasefire remain unclear.

- European equities also reversed some of their year-to-date gains with Trump’s threat of large tariffs against French and European wines and spirits.

Asset allocation observation

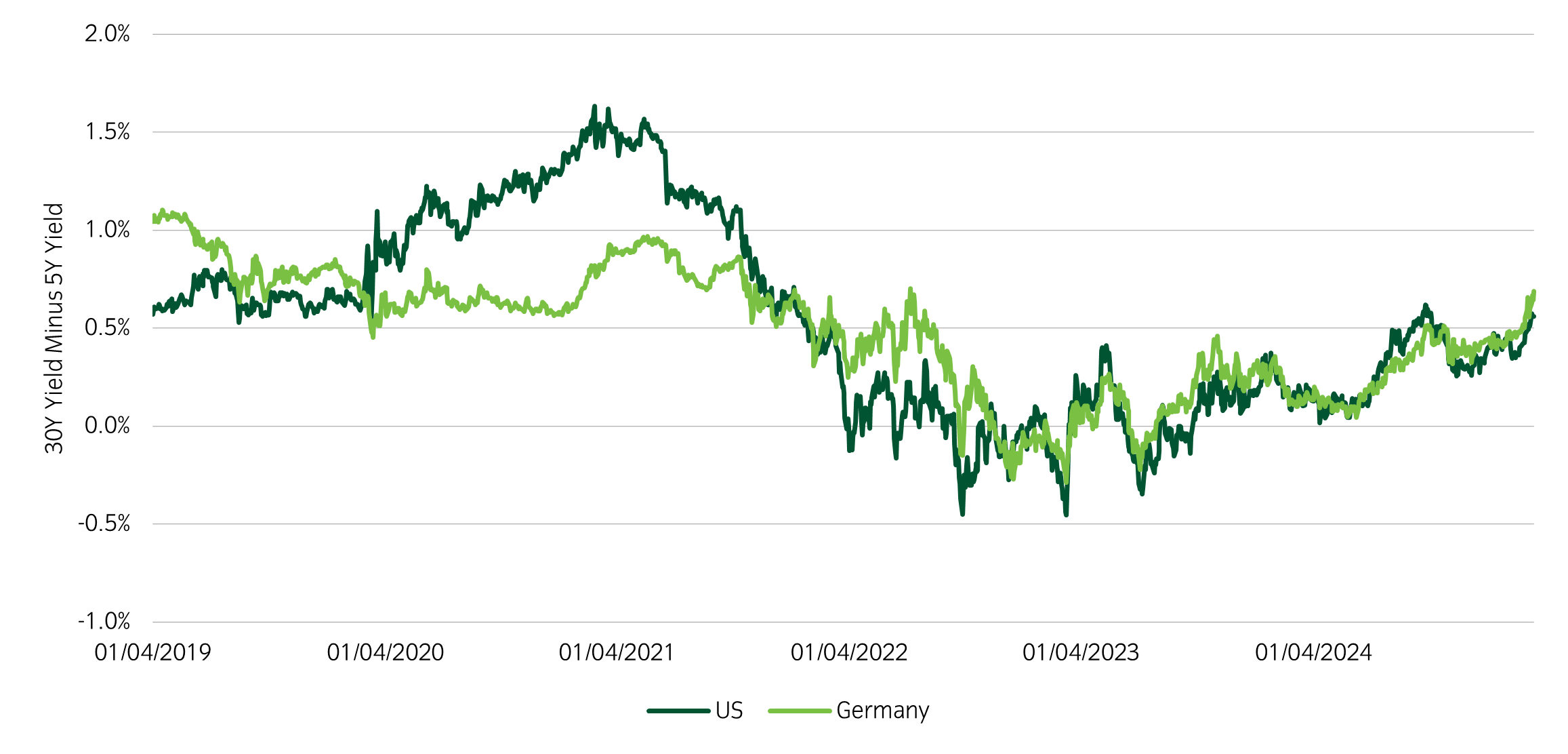

Steeper bond yield curves

Source: Insight and Bloomberg as at 13 March 2025.

- Yield curves in both the US and Europe steepened in recent weeks. This means that yields for the longer end of the curve (10-year and 30-year yields, for example) increased more than yields for the shorter end of the curve (2-year and 5-year yields, for example).

- There appears to different reasons for the steepening in yield curves in the US and Europe. The market has been pricing in growth concerns in the US and pricing in higher probabilities of rate cuts by the Fed in 2025. In Europe, on the other hand, the market has been pricing in the prospect of increased defence and fiscal spend. All else being equal, new expansionary fiscal policy tends to boost expectations for growth and inflation, and thus higher yields in longer-term bonds.

- Within our portfolios, we have a US steepener position that is long US short-term bonds and short US long-term bonds. This position has benefited as long-term yields have increased by a larger amount compared to short-term yields.

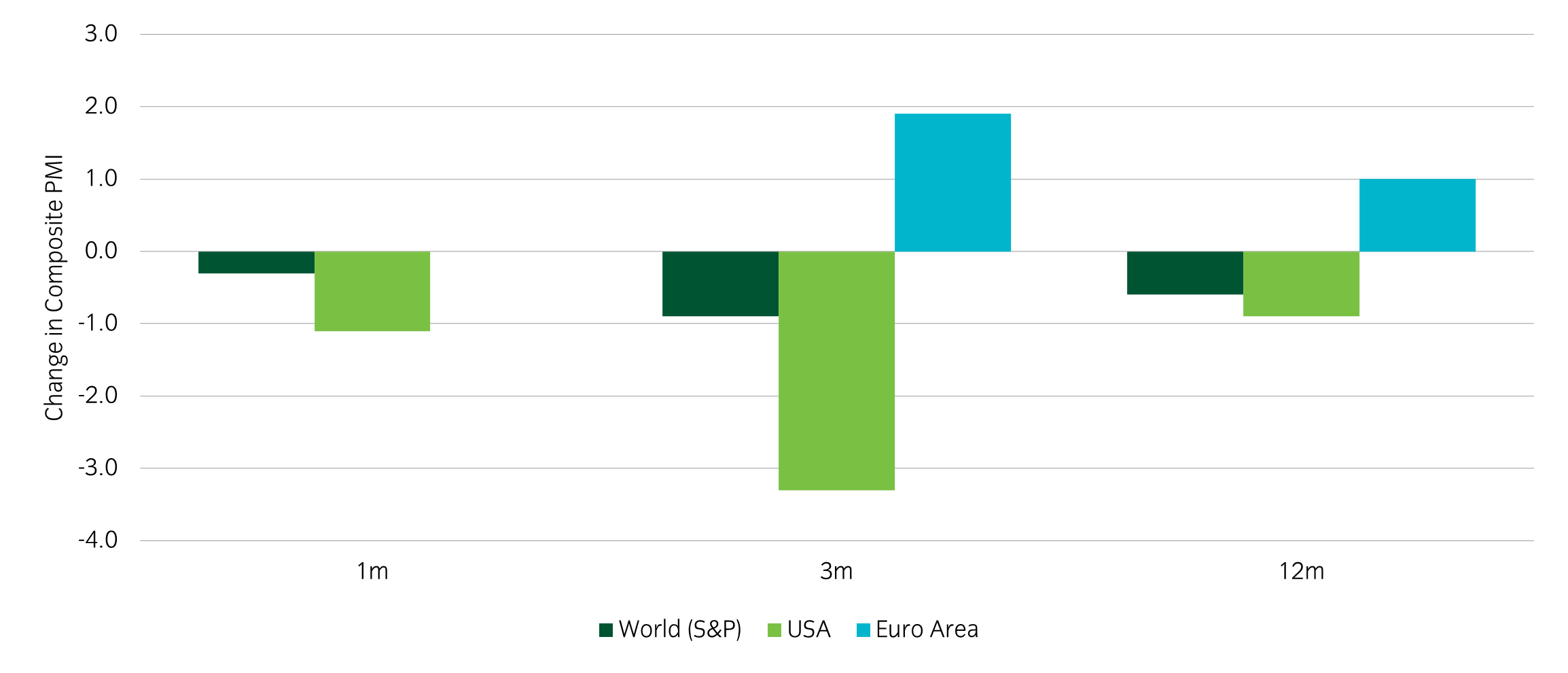

Chart of the week

European composite PMI improving / US composite PMI moderating

Source: Bloomberg and Insight Investment as at 06 March 2025

- There is increasing divergence between the US and Europe in the trend of composite PMIs. The US composite PMI has been declining in recent months, while the European composite PMI has been improving.

- Improving growth data, combined with potentially higher fiscal stimulus (specifically defence spending) in Europe, has dominated the narrative this week and has been reflected in diverging asset class moves between the two regions.

Significant market moves this week

Source: Bloomberg and Insight as at 06 March 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: European and Chinese equities perform well, USD declines.

Over the past week, several things caught our eye:

- The European Central Bank cut its policy rate by 0.25%, but this was largely expected by the market and German bund yields climbed sharply by 0.4%. The potential for large fiscal stimulus and improving PMIs in Europe overshadowed the narrative and drove the relatively extreme bund yield movements.

- Hopes for US support for Ukraine declined dramatically, as Presidents Trump and Zelensky clashed publicly. The clash has apparently acted as a further catalyst for European countries to increase defence spending and general fiscal support. European defence companies continued their strong recent rally.

- US equities and the USD continued to decline this week. The US pressed on with planned tariffs against Mexico, Canada, and China before backtracking several days later. Higher tariffs may spike inflation and reduce global growth. Overall, the general policy uncertainty caused by the Trump administration has dampened risk sentiment.

Asset allocation observation

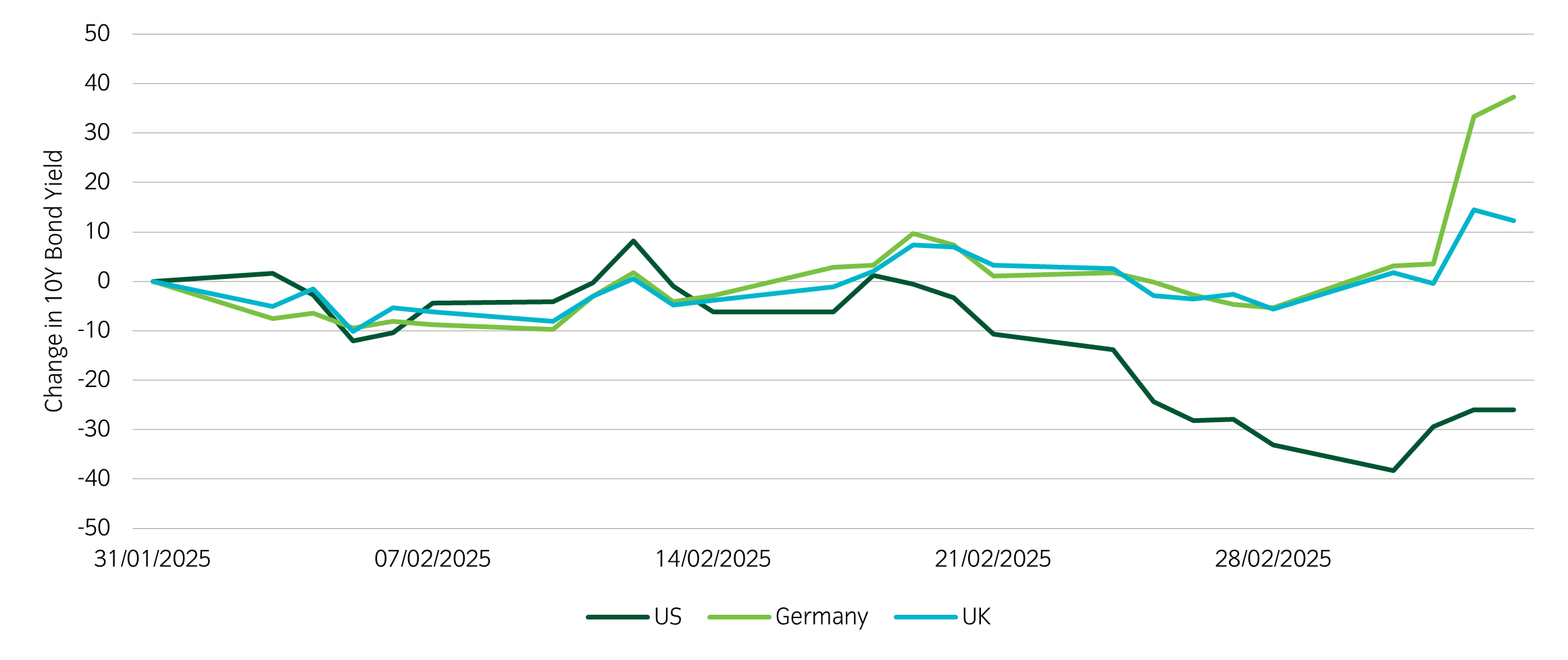

Regional divergence in bond yield moves

Source: Insight and Bloomberg as at 06 March 2025.

- 10-year bond yields in Europe have increased in recent weeks, while the 10 year bond yield has declined in the US. Over a long-term horizon, developed market bond yields tend to move together so the current regional divergence creates an interesting environment for opportunistic trades.

- The recent divergence has been due to some improving growth data and hopes for fiscal stimulus out of Europe alongside moderating growth data and policy uncertainty in the US.

- Within our portfolios, we have a relative value position pairing long UK bonds with short German bonds. This position has benefited from the sharp increase in German bond yields over the week.

Most read

Multi-asset

March 2025

Multi asset chart of the week

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Australia

Australia