|

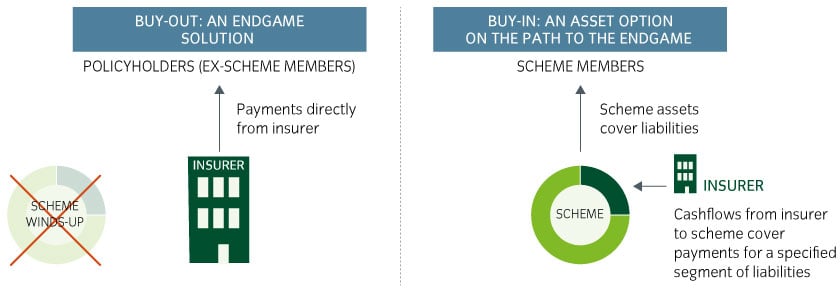

An insurance buy-out is the destination point at which trustees and sponsors can be confident of securing all the members’ benefits, i.e. an endgame solution. An insurance buy-in is a potential investment option to help trustees move towards their endgame, which is usually a buy-out. |

Under an insurance buy-out, trustees typically transfer all¹ their assets and liabilities to an insurance company. The insurer takes on legal responsibility for fulfilling pension obligations to scheme members. The corporate sponsor divests all responsibility for the scheme, and scheme members become policyholders with the insurer. This allows the trustees to wind up the scheme, extinguishing all governance responsibilities

Under an insurance buy-in, trustees typically transfer some² of their assets to an insurance company in return for a cashflow stream that reflects the actual pension payments for a portion of the scheme membership (the members insured). The insurance company makes payments to the scheme, which in turn makes payments to the pensioners. The trustees retain the governance responsibility, effectively making the buy-in an asset of the scheme.

Figure 1: How buy-outs and buy-ins support payments to pensioners

1Partial buy-outs are possible, but in the UK they are rare because this could leave trustees open to breach of their fiduciary duty to treat all members fairly in the subsequent event that there are insufficient assets to pay the remaining members’ benefits.

2There have been some cases where trustees have conducted a buy-in for all of their liabilities, but this is usually a short-term, pragmatic step to extinguish the mis-match risk while preparing the details for a buy-out, and subsequent wind-up of the scheme.

3For illustrative purposes only.Potential investment impact.

Potential investment impact

Once a buy-out is complete, the pension scheme has wound up, and scheme members are individual policyholders with the insurer.

Following a buy-in, when looking at the notional portion of the members that have been insured, it can appear that there are no investment implications as their pension payments are matched exactly by the insurance contract (ignoring any governance costs incurred by the scheme for managing these member benefits). However, when looking at the scheme as a whole, there can be significant investment implications.

Buy-in transactions typically do not cover non-pensioners, and therefore the longer-dated and most risky liabilities typically remain uninsured. So, schemes may transfer disproportionately more assets than risks to the insurer. In addition, an insurance buy-in ties up a significant proportion of the scheme assets and cannot be reversed – this can reduce the ability to deal with unpredictable events.

The investment implications may be four-fold:

- Impact on the return required from remaining assets

- Impact on the scheme’s ability to hedge its liabilities

- Impact on the time to achieve a full buy-out

- Flexibility to deal with the unpredictable

The analysis when considering buy-outs and buy-ins needs to be different

Table 1: A summary of the differences between a buy-out and a buy-in

| Buy-out | Buy-in | |

| Purpose | Endgame solution | One option on the path to the endgame |

| Practicalities | Transfer all assets and liabilities No further governance obligations |

Transfer some assets in return for a cashflow stream that reflects some liabilities Retain all liability and governance obligations |

| Potential investment impact |

No further investment mis-match risk | Asset that reduces the mis-match risk for a notional portion of the liabilities, but could increase the time to, and cost of reaching, the target endgame overall |

| Analysis required when comparing to other options |

Cost versus residual risk of managing liabilities |

Return required from remaining assets Ability to hedge the remaining, or uninsured, liabilities Time to achieve the target endgame Flexibility to deal with unpredictable events |

Source: Insight. For illustrative purposes only.

Most read

Global macro, Fixed income

October 2023

Global macro research: Yield-curve inversion – an unreliable recession signal?

Global macro

July 2023

Global macro research: Asset allocation in focus

Global macro

May 2023

Global macro research: Why central banks may struggle to solve the inflation puzzle

Fixed income

August 2024

Ireland

Ireland