A Q&A with Jason Cameron, Head of US Structured Credit and Melissa Niu, Portfolio Manager

|

|

| Jason Cameron | Melissa Niu |

What is esoteric structured credit?

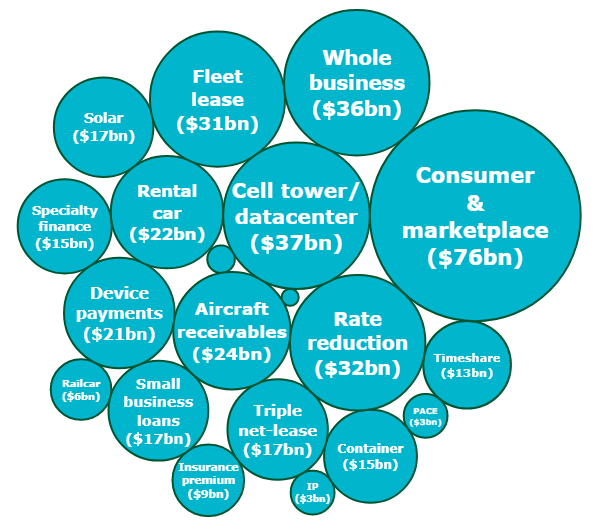

Jason: It’s the fastest-growing “non-traditional” credit market. We estimate it at $400bn at the end of 2023, up ~$100bn since 20201.

Think of it as an extension of traditional structured credit.

Deals are available in either public market or private “club” formats. The “esoteric” part can refer either to unconventional underlying asset pools or innovative private structures, or both.

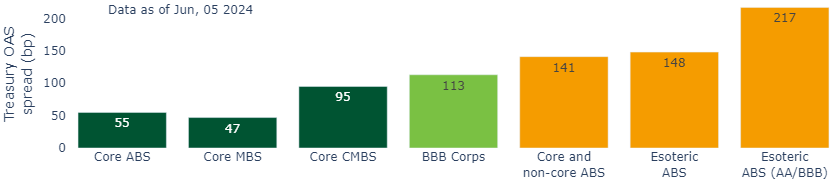

What type of a premium have these assets offered?

Jason: Typically, esoteric credit has offered a significant “complexity premium” above the traditional structured credit that investors hold in their core or “Agg-benchmarked” fixed income allocations.

It has also typically offered anywhere from +50bp to over 300bps versus comparably rated corporate bonds, depending on market conditions, or a deal’s structural complexity and liquidity.

So, if you think that bond yields are generally attractive in the current environment, as we do, but are concerned about narrow credit spreads in traditional credit, esoteric structured credit could be a sweetspot.

Figure 1: The $400bn esoteric structured credit universe1

Figure 2: Esoteric structured credit has typically offered a premium over core ABS2

You mentioned the market’s growth – why is esoteric credit growing so fast?

Melissa: Esoteric structures reflect trends at the cutting edge of economic activity. Right now, the cutting-edge is digital infrastructure, like datacenters and fiber-optic cables. The rise of AI has accelerated this and so this build out is hungry for finance.

Another example is the rise of the streaming services we all watch. It is creating opportunities to monetize assets like film, television and music rights and securitize them into bond structures with high degrees of credit enhancement and high credit quality.

Jason: The other main driver is the retrenchment of banks from this type of lending, given capital and liquidity constraints in the post-2008 regulatory environment. This is only becoming more of a theme with the implementation of Basel III, and in the aftermath of last year’s regional banking crisis.

Many esoteric players are private entities, so their natural funder has historically been banks. This has increasingly opened the door for institutional investors to step in, and we have already seen this from pension and life and annuity insurance capital in particular. It’s no surprise to us that some of these esoteric asset classes are tapping the capital markets. A report from Research and Markets projects total asset based private lending/finance to almost double over the next four years3.

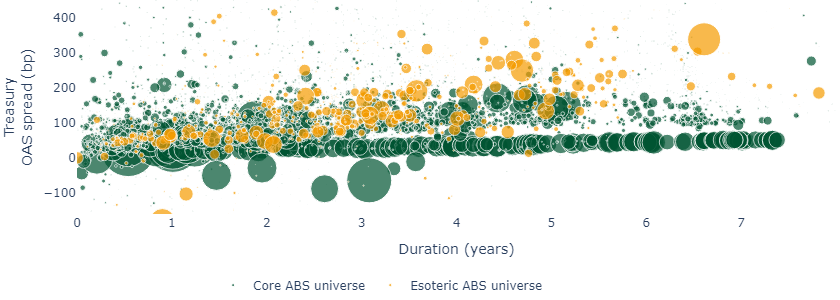

Figure 3: The esoteric structured credit market is exploding4

How do private and public esoteric debt differ?

Melissa: There are definite advantages to private deals. Issuers often prefer low levels of disclosure so they value having only a handful of investors. For investors, doing the heavy lift of underwriting the deal, often guarantees a seat at the table.

Contrast this to public markets where there are many other investors, so achieving your desired allocation and price can be difficult.

Jason: But don’t dismiss public debt. When we compare the attractiveness of two similar public and private deals, the private one doesn’t always win. The “illiquidity” premium has compressed since 2021, but the “complexity” premium still looks attractive. The public esoteric market, given how much easier it is to access, could potentially be the ideal way for investors to dip their toe into the market. Also at times of liquidity stress in the market, private deal flow can often dry up while pricing in the public market can dislocate, providing attractive opportunities.

Figure 4: Esoteric ABS has typically offered a premium over core ABS5

Melissa: Yes, Publicly syndicated issues have their own advantages. Private, directly originated deals are slow-going, for viable deals it can take 12 to 18 months between a first conversation and funding. In a syndicated opportunity we might feel comfortable about it within weeks.

When partnering with a manager in esoteric structured, what should investors look for?

Melissa: Managers need their own specialist teams of structured credit investment portfolio managers and analysts, ideally operating globally with a high degree of experience investing in ABS and more esoteric types of private lending. Scale is crucial, it takes resource and experience to repeatedly unlock that complexity premium.

Depth of relationships is also important. The esoteric market is quite a “clubby” community. You repeatedly see the same banking professionals at the table and handful of lawyers looking at certain deal types. I think sourcing, critically, comes from long relationships. Naturally, the first phone calls from issuers are likely to go to those they worked with successfully before. Similarly, a manager’s ability to bring sizeable investment commitments is an important factor for participating in deals.

From an underwriting standpoint, drawing heavily on the different areas of a full-service global fixed income asset manager can be a major advantage. For example, our team draws on our corporate credit analysts when considering deals tangential to infrastructure and project finance. Elsewhere, we’ll draw on the expertise of our municipal bond colleagues, as a lot of esoteric asset classes may historically have resided in that asset class. It’s an essential defense against being taken advantage of or arbitraged in some way.

Jason: I would also note that to properly underwrite esoteric ABS, investors often need legal resources, specialized knowledge and quantitative models. While structures often include rated notes, as an investor we never want to be reliant on a rating agency view of the credit quality and robustness of a structured investment. We believe understanding the underlying risks and mitigants, legal structure and protections, and stress testing these transactions is fundamental to successful investment in this space.

Figure 5: Select case studies6

| Deal: March 2023 | Deal: March 2023 | |||

|---|---|---|---|---|

| Structure | Private-Club | Structure | Private-Club | |

| Collateral: | Agricultural Production Loans | Collateral: | Trade Finance (inventory and receivables) |

|

| WAL: | 3 years | WAL: | 5 years | |

| Spread: | UST + low-mid 200bps | Spread: | Libor swap curve + low-mid 400bps |

|

| Rating: | A | Rating: | A |

How are your clients using esoteric structured credit?

Melissa: For insurance companies and pension funds I think we see it as an extension of their “core” fixed income holdings.

Structured credit can typically help them address their liability streams, as the cashflows are contractual and predictable, particularly given that they are secured against underlying assets with credit enhancement. Given a compelling yield backdrop, esoteric credit may offer generous coupon income, allowing clients to meet their cashflows without being forced to sell assets.

Further, other clients that hold large cash balances see high quality structured credit as crucial to securing an enhanced liquidity portfolio. Incorporating high quality esoteric ABS can potentially help improve yields without comprising on safety or liquidity.

Why have some investors been slower to embrace esoteric investments?

Melissa: I think uncertainty and lack of familiarity – some assume esoteric means strange and bizarre assets, although they tend to be relatable economic staples, and are assets that investors have already been underwriting by financing corporate balance sheets. The only new element is really the securitized wrapper around these cashflows, which we think is the key to ensuring high credit quality.

But there’s also complexity – understanding and having the resource and legal expertise to go through the documents is a hurdle. It's also taken some time for rating agencies to cover esoteric deals. Lower liquidity within private deals can also be a concern, as it can be considered an “alternative or opportunistic” credit component and difficult to place within an allocation.

Jason: Don’t forget that what we see as “esoteric” today, may become “traditional” in the future. Getting ahead of the curve now means being active in new types of deals while the market still bestows a premium on it.

Contributor

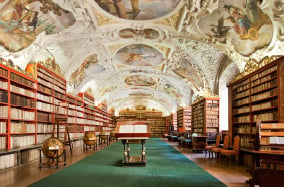

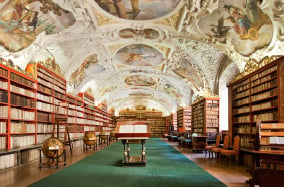

Jason Cameron

Head of US Structured Credit, Insight Investment

Jason joined Insight in January 2015, following BNY Mellon’s acquisition of Cutwater Asset Management (Cutwater). Jason initially joined Cutwater in 1999 and has extensive financial engineering and portfolio management experience. He heads up Insight’s US Secured Finance Team and is also responsible for the US CLO and global trade finance investment activity for the firm and managing structured finance focused funds. Previously, he was a Quantitative Analyst in Capital Markets Assurance Corp's (CapMAC’s) Financial Engineering Group and its successor, the Alternative Structured Finance Investments Group of MBIA Insurance Corp where he was involved in structuring and risk taking in CLOs and esoteric securitization transactions. Prior to joining CapMAC, Jason was an Assistant Vice President and quant in the Strategic Business Planning and Analysis Team at Citibank’s World Wide Securities Services Division. He started his career as a Financial Risk Technologist at General Electric’s Corporate Research and Development Center. Jason holds a BA (Hon) degree in Economics from the University of Western Ontario and an MA in Economics from the University of British Columbia. He also holds Series 7 and 63 licenses from the Financial Industry Regulatory Authority (FINRA).

Melissa Niu

Portfolio Manager - Investment

Melissa joined Insight’s Fixed Income Group as an analyst within the Secured Finance Team in 2005 (via predecessor company, Cutwater Asset Management) and has worked in the financial service industry since 1997. Melissa focuses on evaluating investment opportunities in the commercial real estate sector with an emphasis on CMBS, CRE CLOs and CRE whole loans. She also covers commercial and esoteric ABS, the aircraft sector and has secondary research responsibilities for transportation and other areas. Previously, Melissa was with the Global Structured Finance Group at MBIA Insurance Corp.’s, structuring asset backed transactions. Prior to this role, she served as a senior credit analyst on the International Business Team at CITIC Bank, underwriting Letters of Credit. Melissa holds a BA degree from Shanghai International Studies University, an MA degree from Brigham Young University and an MBA from Yale University. She is also a CFA charterholder.

Most read

Global macro

April 2022

Global Macro Research: Modeling the persistence of US inflation

Global macro, Fixed income

May 2023

Global Macro Research: Debt ceiling stand off

Liability-driven investment, Fixed income, Responsible investment

December 2023

Thoughts for 2024

Fixed income

June 2024

United States

United States