Headline CPI came in lower than expected for the first time this year, at 0.3% in April. Core prices also rose 0.3% (in line with expectations). This takes Headline CPI from 3.5% to 3.4% year-on-year and Core CPI from 3.8% to 3.6% (the lowest since April 2021).

We believe disinflationary trends remain in place. While stubbornness in core services categories likely mean the Fed has not seen enough progress in inflation to consider cutting at its June meeting, we believe that rate cuts remain in play from September.

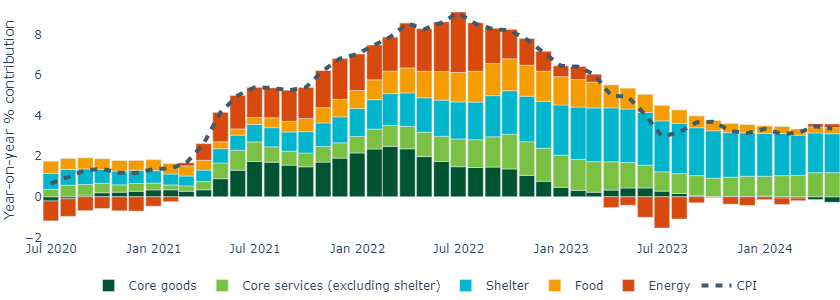

Core services still dominate CPI

Energy inflation remained significant, rising 2.6% year-on-year from 2.1% last month, given relatively elevated global oil and domestic gasoline prices through April. However, energy prices have fallen over May so far, which may bode well for next month’s CPI release.

Food inflation remained steady, despite concerns of rising fast-food prices in California in response to higher minimum wages. The core goods segment was negative year-on-year, with durable goods prices and vehicle prices (new and used) falling.

Figure 1: Core services categories continued to dominate

Source: Bureau of Labor Statistics, Macrobond, May 2024

Core services categories remained the largest contributors to inflation given their “sticky” nature.

The shelter category (which has the largest weight in the index) renewed its gradual descent, slowing from 5.7% to 5.5% year-on-year. We expect this to continue. Encouragingly, excluding shelter, CPI slowed from 2.3% to 2.2% year-on-year.

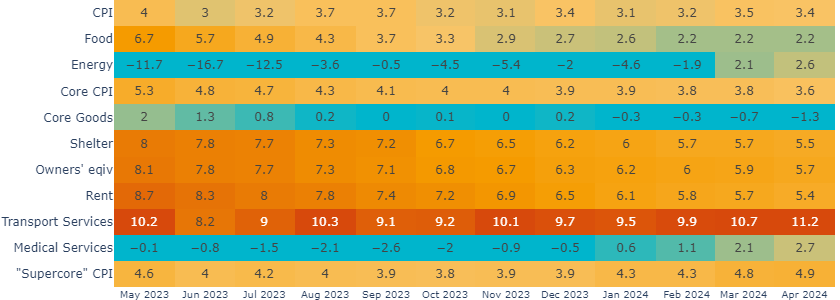

The “supercore” categories (core services excluding shelter) remained stubborn, however, rising from 4.8% to 4.9% year-on-year. Transportation and medical services both decelerated month-on-month but accelerated year-on-year (Figure 2). Within transportation services, auto insurance (typically a “sticky” category) is running at 22.6% year-on-year, its fastest annual pace since the 1970s.

Figure 2: Core services also remain ''sticky"

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, May 2024

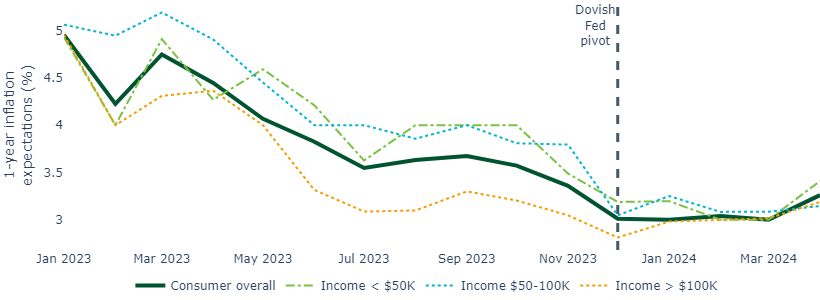

Inflation expectations have shifted

Earlier this week, the New York Fed’s survey of consumer expectations showed inflation expectations for the next year at their highest levels since November – just before the Fed’s dovish pivot. Consumers earning less than $50,000 (likely to be the most inflation-sensitive) raised their estimates the most (Figure 3).

Figure 3: Inflation expectations are back to pre-December levels, particularly for the most inflation-sensitive cohorts

Source: New York Fed, Macrobond, May 2024

Market pricing around rate cuts have similarly shifted course. Markets were pricing in six cuts in 2024 back in January and now are pricing slightly less than two cuts, similar to pricing last Fall.

We believe this remains a compelling time to consider fixed income

We believe that disinflationary trends remain in place. While a rate cut in June looks highly unlikely, we believe that the FOMC meetings from September onward remain in play. However, core services will remain a concern for the Fed and we believe the committee will be keep a keen eye on how pricing in that segment evolves.

We still see two rate cuts in 2024 as a reasonable base case and believe market pricing now reflects more realistic expectations as to the timing and pace of the rate cutting cycle. As such, in our view it is a compelling time to consider structurally allocating to fixed income before rate cuts take effect.

United States

United States