Events are changing very quickly and, for now, the US has announced a 90-day delay for tariffs above the 10% baseline other than for China. However, for the purpose of stress testing our views it is prudent to work on the basis that the US will return to its original plan once markets have settled down.

When we consider the effect of the new tariff regime on global economies, although the scale of impact is likely to vary significantly between countries, the direction, at least on growth, is likely to be overwhelmingly negative.

UBS has conducted a scenario analysis to estimate the economic impact based on how the rest of the world responds to the new US tariff regime (see Figure 1). While this provides an interesting baseline, the actual impact will likely be far more complex due to the considerable impact of uncertainty on growth. Until businesses and consumers have a greater sense of stability, they will almost certainly push back major financial decisions, which becomes a headwind to growth.

The models used to calculate these scenarios will also include assumptions around elasticities of demand, and the scenarios around currencies assume the USD either goes up or is unchanged, when actually we have seen a weaker USD in the last few days (although this may not last).

The analysis starts with three main scenarios: full retaliation, half retaliation and no retaliation, under which countries match US tariffs at a rate of 100%, 50% or 0% respectively. It then examines the impact under a range of underlying sub scenarios:

- Baseline: the preferred parameterization, with portfolio valuation effect calibrated by net international investment position (NIIP).

- Full exchange rate flex: baseline scenario but shutting down the portfolio valuation effect on exchange rates.

- No exchange rate flex: baseline scenario but currencies do not react to trade flows.

- Full price and exchange rate flex: all prices and exchange rates adjust fully (with no stickiness in price margins, except wages).

Figure 1: Global simulation of the new tariffs from UBS1

Given the responses so far from China and the European Union we can discount the ‘no retaliation’ scenario, but even ignoring this the estimated trade channel impact on US GDP varies between -0.1% to -3.4%, while the impact on US inflation varies between +0.4% to +2.2%. In the eurozone, the trade channel impact on GDP varies from -0.1% to -0.8%, and the impact on eurozone inflation from +0.1% to +0.6%.

When a single model from a very well-resourced research team can produce such variance, it demonstrates that any forecasts need to be treated with appropriate caution.

Trade channel impact on growth

The most direct impact of tariffs on growth in exporting markets can be assessed by examining the proportion of GDP (or GVA) exposed to the US. We can then multiply this by the change in average tariffs, and the elasticity of demand can be considered to determine how the burden is ultimately split between producers and consumers. We can also estimate the impact on the US by assuming equal retaliation from China and the EU, where the average tariff rises by the same amount. We have not accounted for elasticity of demand, implicitly setting it at 1, whereas academic studies typically suggest a lower figure.

As we can see in Figure 2, the impact is negative across the board. We have highlighted some notable countries in light green – these include China, which has a negative growth impact of -1.1%, Japan at -0.9%, the eurozone at -0.44%, the UK at -0.11% and the US at -0.41%, but this only takes account of EU and Chinese retaliation, not Canada or other economies which may also retaliate.

Figure 2: Impact of tariff announcements on 2025 growth (exposure US % GDP * tariff change)2

As at 3 April - does not take account of changes made to tariff regime since then.

Confidence channel impact on growth

The confidence channel can potentially have a larger impact than the direct trade channel, although it can ultimately reverse if uncertainty diminishes in the future. Forecasting the impact of uncertainty is inherently challenging due to the unpredictability of confidence and animal spirits. Additionally, it is difficult to estimate how long uncertainty will prevail, as the impact on growth tends to wane the longer it continues. Some investment decisions become increasingly critical and can no longer be postponed. Given the scale of the shock, it seems reasonable to believe the impact will be of comparable scale to the previous trade war in 2018, where GDP growth fell by 3% in the US.

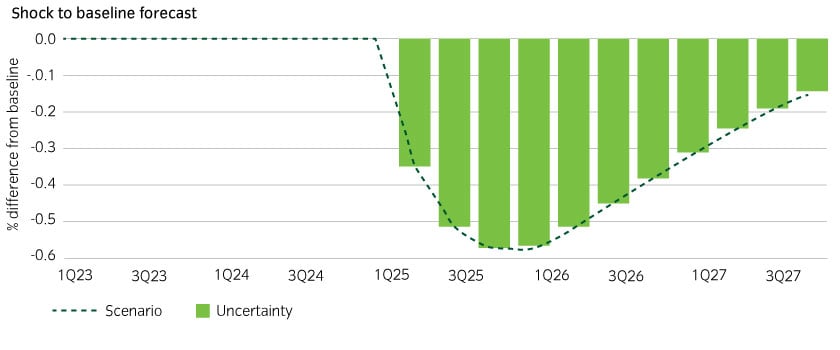

Modelling an uncertainty shock of 2.5 standard deviations, equivalent to the rise in VIX we have seen in the week following the tariff announcements, projects a minimum impact to US growth of -0.6% relative to baseline (see Figure 3). Performing the equivalent model for other countries gives a minimum impact of -0.21% for the eurozone, -0.55% for the UK, and -0.59% for China. However, China is expected to rapidly recover to -0.14% due to the planned stimulus by the authorities.

Figure 3: Modelled impact of uncertainty on US growth3

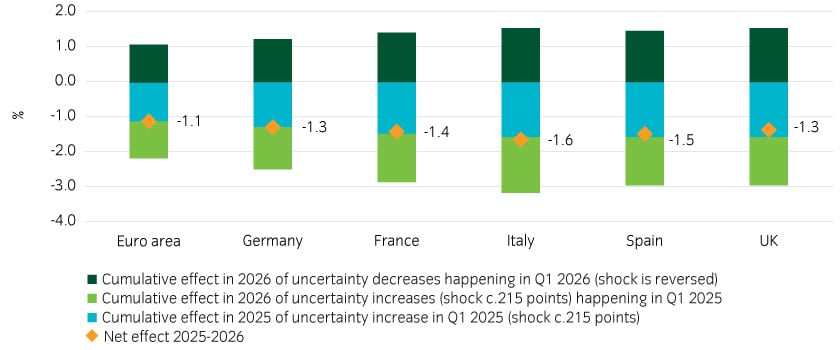

Considering the uncertainty impact for the EU and UK, an impact is estimated of -1.1% and -1.3% respectively over 2025 and 2026 (see Figure 4).

Figure 4: Change to real GDP growth due to trade policy uncertainty shocks (October 2024 to March 2025)4

Aggregate growth impact

We pull all of these numbers together in Table 1. The news flow is evolving at a rapid pace, but we will be incorporating this analysis into our internal debate as we assess the longer-term impact of the new global trade regime in the weeks ahead.

Table 1: Aggregate impact on growth5

Most read

Global macro

April 2022

Global Macro Research: Modeling the persistence of US inflation

Global macro, Fixed income

May 2023

Global Macro Research: Debt ceiling stand off

Liability-driven investment, Fixed income, Responsible investment

December 2023

Thoughts for 2024

Fixed income

June 2024

United States

United States