Inflation was higher than the market expected in January. Headline consumer prices rose 0.5% in January, taking headline CPI from 2.9% to 3% year-on-year. Core prices (which exclude food and energy components) rose 0.4% in January, taking core CPI from 3.2% to 3.3%.

We believe that the print is not as concerning as it appears at first, as pricing in January tends to be subject to residual seasonality that is difficult to capture with seasonally adjusted data.

Egg shortages help push up food inflation

Volatile CPI categories generally accelerated in January.

Food inflation was 0.4% in Janaury, the highest since February 2023. Half of this was driven by a 15.2% rise in egg prices, which remain subject to avian-flu related shortages. Energy inflation also remained elevated for the second month in a row, up 1.1% in January, driven by gasoline and natural gas. Core goods prices rose 0.3%, the highest since May 2023.

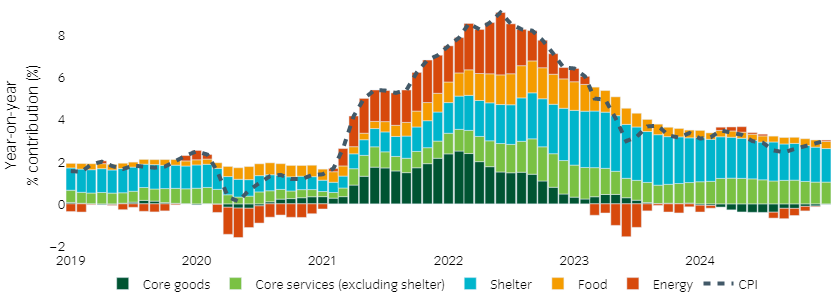

Figure 1: Progress in headline inflation continues to be slow

Source: Bureau of Labor Statistics, Macrobond, Insight, February 2025

Encouragingly for the Fed, inflation in the stubborn core services sectors was less pronounced.

Shelter inflation continued its gradual disinflationary trend, reaching 4.4% relative to a year earlier, the lowest since January 2022.

The “supercore” services component (which excludes shelter) grew 4% year-on-year, remaining relatively muted in January outside of transportation services, which accelerated largely due to a 2% increase in motor vehicle insurance prices.

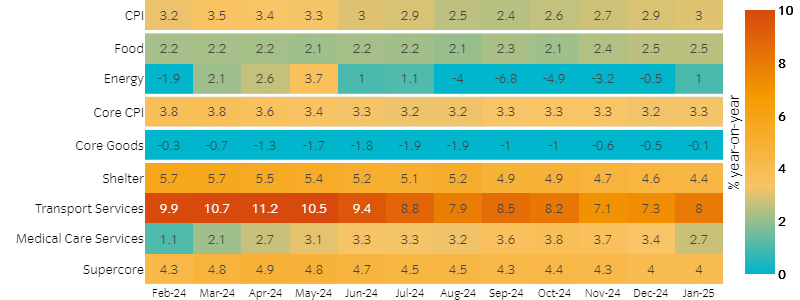

Figure 2: The “stickier” core services segments continue to move in the right direction

Source: Bureau of Labor Statistics, Macrobond, Insight, February 2025

Tariffs continue to pose uncertainty

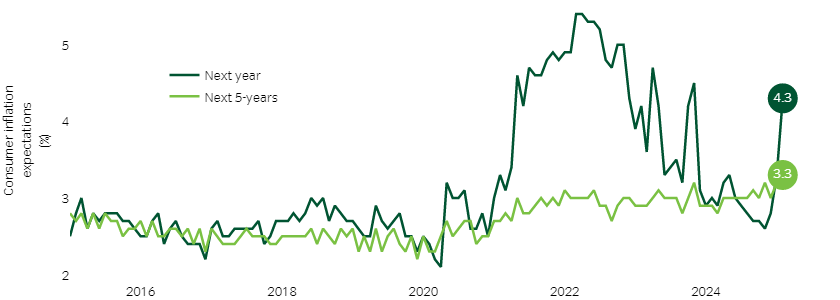

Consumers are starting to react to uncertainty around the administration’s tariff policies. The University of Michigan’s latest survey showed shorter-term inflation expectations spiking by a percentage point to 4.3%, and longer-term expectations also higher (Figure 3).

Figure 3: Consumer inflation expectations spike on tariff concerns

Source: University of Michigan, Macrobond, February 2025

We expect the Fed to remain biased to cut rates

We believe that disinflationary trends remain in place, driven by grading improvements in “stickier” sectors like shelter and “supercore” CPI.

We suspect the Fed may look through strength in food and energy categories (which are potentially transitory), and be mindful of seasonal adjustment-related distortions in shorter-term data.

Policy uncertainty remains, nonetheless. However, while tariffs have the potential to introduce transitory inflation, they also have the potential to impede growth, making for a challenging balancing act for the FOMC.

Ultimately, we expect the Fed to keep rate cuts in play this year, but we will continue to watch political developments closely.

United States

United States