Consumer prices fell 0.1% in June, taking headline CPI from 3.3% to 3.0% year-on-year (the slowest pace since June 2023). Core prices rose 0.1% from May 2024 and 3.3% from last June.

Today’s report follows a string of encouraging recent data prints, and we believe it will offer the Fed greater confidence to commence rate cuts in the near future.

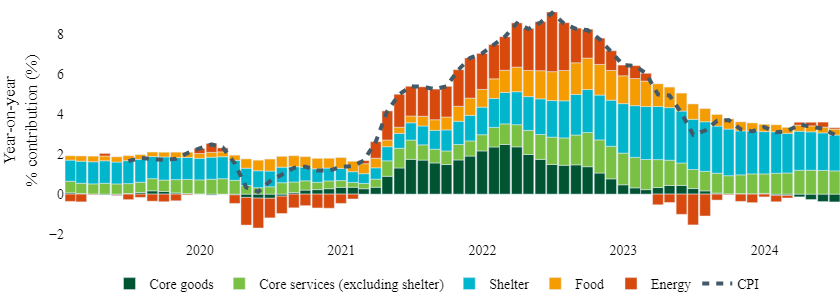

Energy and core goods continue to be disinflationary

Energy prices fell 2% in June, led by a big drop in gasoline prices. Core goods prices also eased, down 1.8% from a year ago (Figure 1).

Figure 1: Energy and core goods continue to help drive disinflation

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, Insight, July 2024

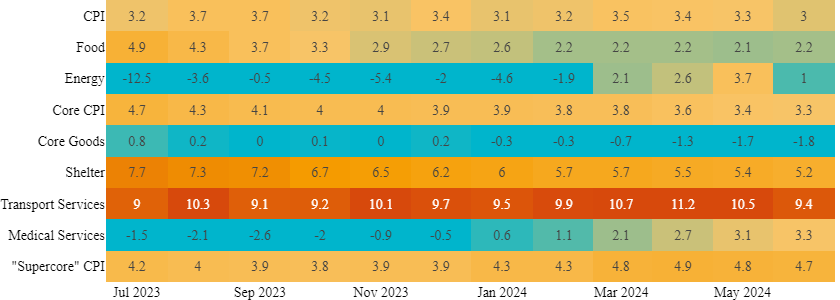

There was also good news across the “sticky” core services categories.

Shelter inflation, which albeit remains stubbornly elevated, rose only 0.2% in June, the lowest monthly print since February 2022 and we expect shelter prices to continue to moderate in the coming months, given the measure tends to lag private rental measures.

Meanwhile, transportation services prices fell 0.5% in June, and growth in medical services prices eased, rising 0.2%, the slowest rate since February 2024.

Figure 2: Stubborn core services categories continue their slow descent

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, Insight, July 2024

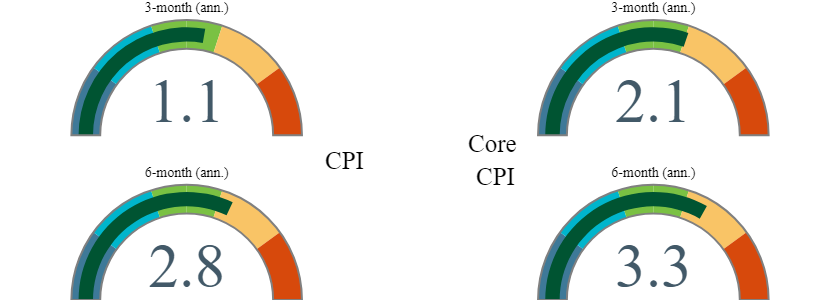

Momentum is encouraging for the Fed

The Fed closely watches the 3-month and 6-month annualized rates of inflation as momentum indicators.

The 3-month annualized headline CPI rate is now just over 1%, and the 6-month measure is below 3%. Both are at the lowest levels since 2020. The 3-month annualized Core CPI rate is also encouraging, at just above 2%, its lowest level since 2021.

Figure 3: CPI’s momentum is encouraging news for the Fed

Source: Bureau of Labor Statistics, Macrobond, Insight, July 2024

We expect this momentum will be particularly encouraging for the Fed, providing more evidence that inflation is now on a sustainable path toward its 2% target. Coupling this with signs that the labor market is cooling, we believe one-to-two rate cuts this year remains a sensible base case.

Overall, we expect this macro picture will be constructive for fixed income asset classes.

United States

United States