We offer five themes plan sponsors should consider in 2025 and beyond:

- Make the most of your surplus

- Address your cashflow risks

- Make your hedge more precise

- Maximize the efficiency of interest rate overlays

- Revisit the credit spread hedge ratio

1. Make the most of your surplus

Corporate DB funded statuses have risen by over 22% on average since June 20201, pushing the average plan into surplus. Therefore, we believe the time is now to re-evaluate end-state objectives and evaluate how best to “spend” their surplus. There are two broad options.

- Full termination (“PRT” or “pension risk transfer”): This fully absolves sponsors of pension obligations and eliminates any uncertainty around meeting them. However, it can be expensive, even unaffordable, particularly for plans without a sponsor contribution.

- Self-management: Managing the plan on balance sheet and growing the surplus can be less costly but with residual uncertainty. The potential economic benefits of growing the surplus can also be shared between participant and sponsor. Common uses of surplus include reopening the plan to new accruals, transferring to a retiree medical program, merging with a second underfunded pension, or funding a qualified replacement plan.

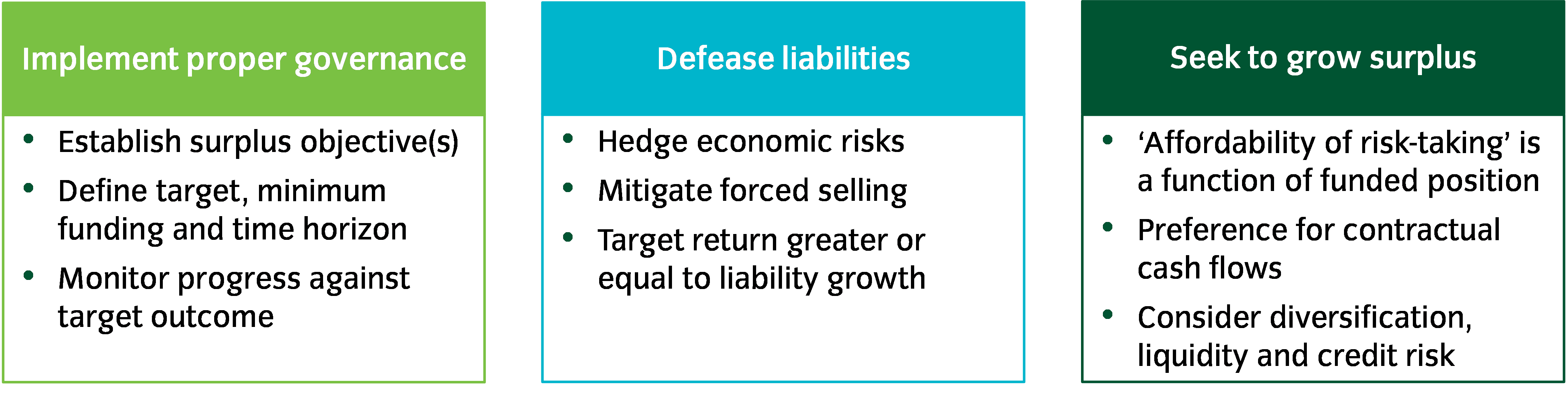

A self-managed investment approach that prioritizes maximizing the certainty of meeting a plan’s objective, that preserves participant benefit security and mitigates risk to the sponsor, could be an optimal path for some. Self-management can, in our view, work either indefinitely or until the plan matures to the point that a PRT becomes more affordable.

Figure 1: Self-management may be an optimal surplus investment strategy for many plans

Source: For illustrative purposes only

2. Address your cashflow risks

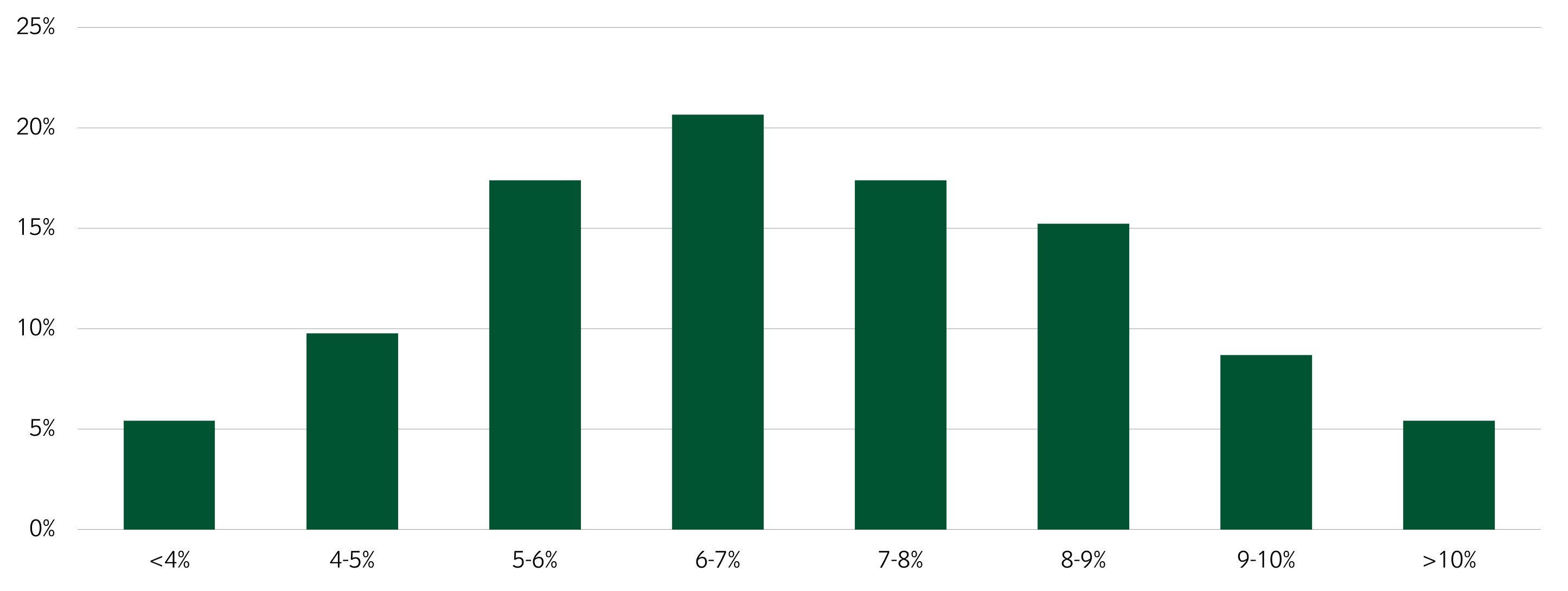

Pension plans’ liquidity challenges are growing. The median pension plan is paying out ~7% of assets each year in benefit payments (see Figure 2). Plans increasingly need to sell assets to meet obligations.

Figure 2: Ratio of 2023 benefits payments to year-end assets for large corporate pension plans

Source: 10-k data for S&P500 DB sponsors with >$1b in assets, Insight calculations, December 2024

Forced selling can introduce risks such as “sequencing” of returns, as selling at inopportune times (such as market downturns) can jeopardize long-term objectives. Growing allocations to illiquid, private assets can further exacerbate liquidity strains.

Pension plans are turning to innovative cashflow-driven investment strategies as a result. Such strategies can help plans to balance long-term growth objectives with immediate liquidity needs. These strategies focus on contractually maturing assets with predictable cashflows, like bonds with fixed coupon and maturity dates. Additionally, some are using overlay strategies to manage their market exposure/expected rates of return while maintaining flexibility to manage liquidity.

3. Make your hedge more precise

As pension plans increase their fixed income allocations (and therefore hedge ratios as they progress through their glidepaths), the relative impact of curve risk, spread risk, and other actuarial factors (such as nuances around the actuarial discount curve or complexities like cash balance interest crediting rates) become more pronounced.

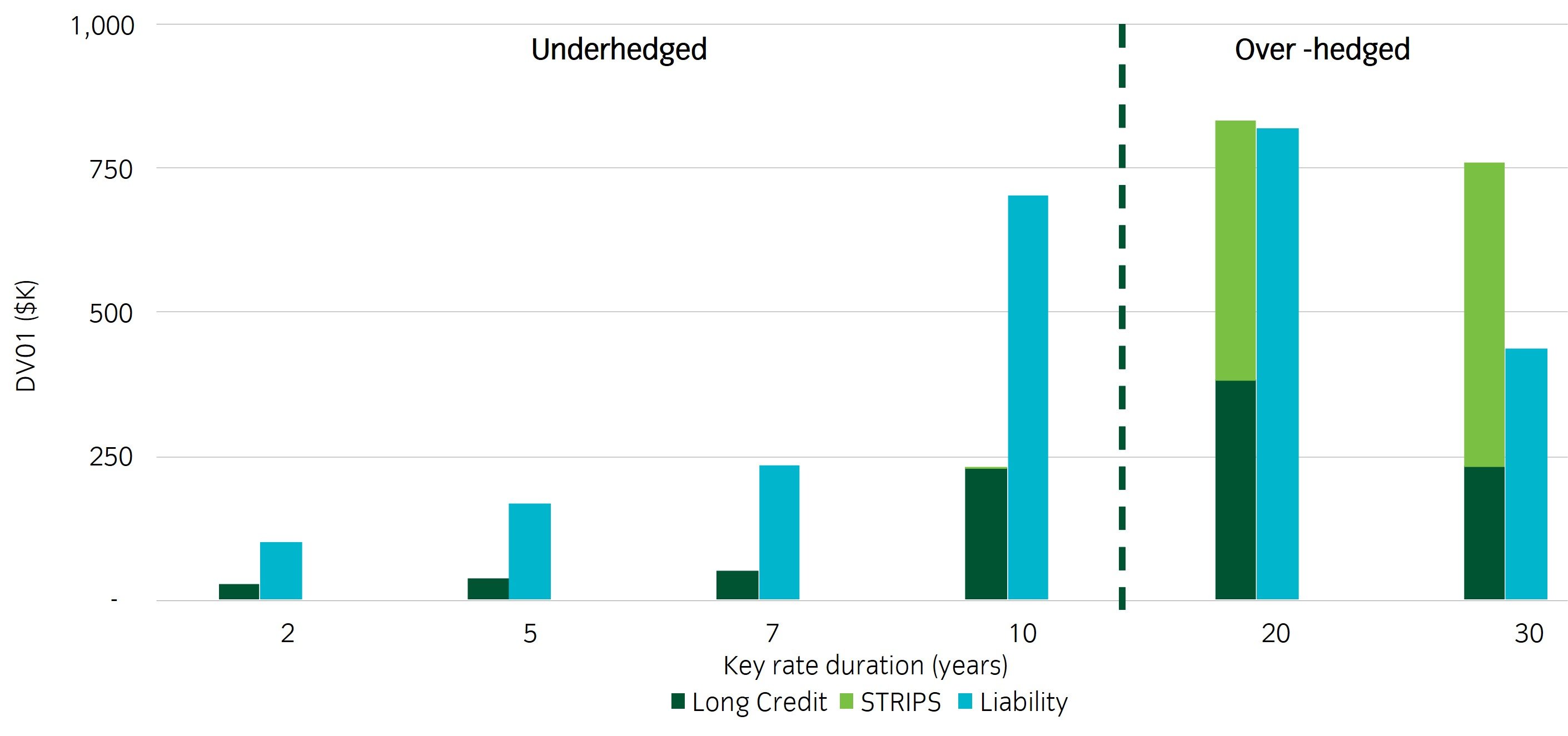

Traditionally, many sponsors have employed broad liability-hedging strategies using long-duration bonds and STRIPS. However, as hedge ratios rise this can lead to overexposure to long-term interest rates and vulnerability to curve steepening, by being “overhedged” at the long end of the curve and “underhedged” at the shorter end of the curve.

Figure 3: Imprecise hedging can introduce yield curve risks (sample pension plan)

Source: Bloomberg, Insight calculations as of September 30, 2024. Sample 100% funded DB plan with 10-year duration hedging 80% of interest rate exposure with 30% allocation to Long Credit and 15% allocation to 20+ US STRIPS.

We believe shifting from market indices to liability-aware benchmarks is a solution. Intermediate credit or other customized maturing fixed income strategies can aim to more precisely hedge cashflows with maturities under 10 years.

Additionally, implementing completion overlays (where a manager directly targets a specific hedge ratio) can potentially enhance hedge precision and capital efficiency. These strategies often use a broader set of instruments, like Treasury futures or Treasury total return swaps, to fine-tune yield curve exposure and achieve desired duration targets without significant asset allocation changes.

4. Maximize the efficiency of interest rate overlays

For plans that have or are considering interest rate overlays, optimizing program efficiency is critical. We believe in three principles:

Work collateral harder

Interest rate overlays require collateral to support daily margining of derivative exposures. Often this collateral is held in cash, money market investments or Treasuries. Allocating collateral to high-quality, liquid, short-duration asset-backed securities (ABS) can enhance yield and provide additional income streams. This strategy allows plans to optimize the capital efficiency of their interest rate overlays by leveraging the spread between the collateral’s yield and the cost of derivative exposures.

Expand the LDI Toolkit:

Broadening the range of instruments beyond Treasury futures enables the LDI manager to rotate into more cost-effective sources of leverage as market conditions evolve. Incorporating instruments like total return swaps and interest rate swaps allow for more precise alignment with liability profiles and improved risk management2. This flexibility enhances the LDI manager’s flexibility to capitalize on dislocations in hedging markets by rotating into relatively cheaper sources of leverage. This type of hedging approach can reduce the long-term cost of hedging by 10-20bp p.a., without jeopardizing the integrity of the hedge.

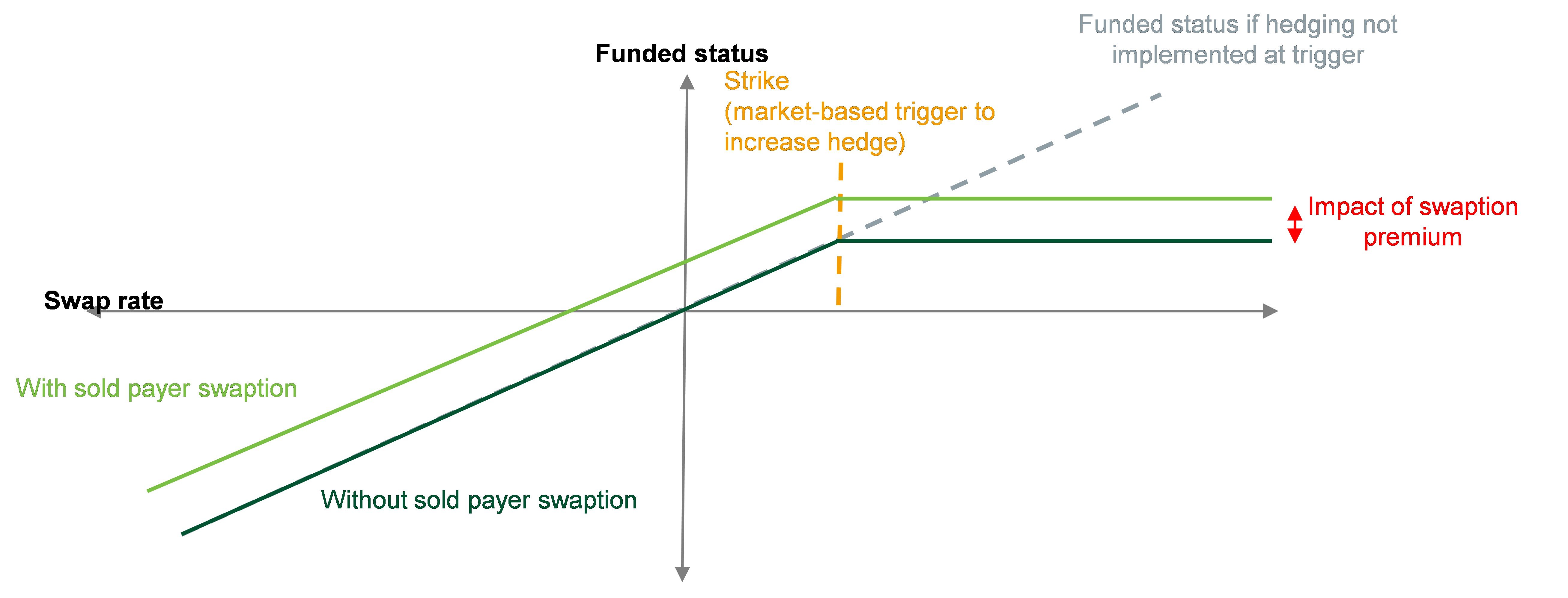

Implement asymmetric liability-hedging strategies:

Asymmetric strategies can potentially manage risk more precisely while enhancing return profiles. These approaches often involve options or replicating of the payoffs of options, offering potential gains without the need for substantial collateral. One application seeks to monetize interest-rate volatility while waiting to lock-in hedges at higher interest rates, providing an additional source of uncorrelated returns.

Figure 4: Asymmetric hedging could be a compelling extension of the LDI toolkit

Source: For illustrative purposes only

Another application is to potentially enhance the capital efficiency of an LDI program by adding downside funded status protection, increasing hedge ratios should rates fall, effectively preserving upside exposure and managing downside rate risk with less capital commitment. This hedging approach is also appropriate for plans with complex risk profiles, such as cash-balance benefits that have the future value of cashflows linked to interest crediting rates that is subject to a minimum level. These types of benefits can have vastly different durations depending on the relationship between the interest crediting rate and minimum (duration is high when well below the floor and close to zero when well above it).

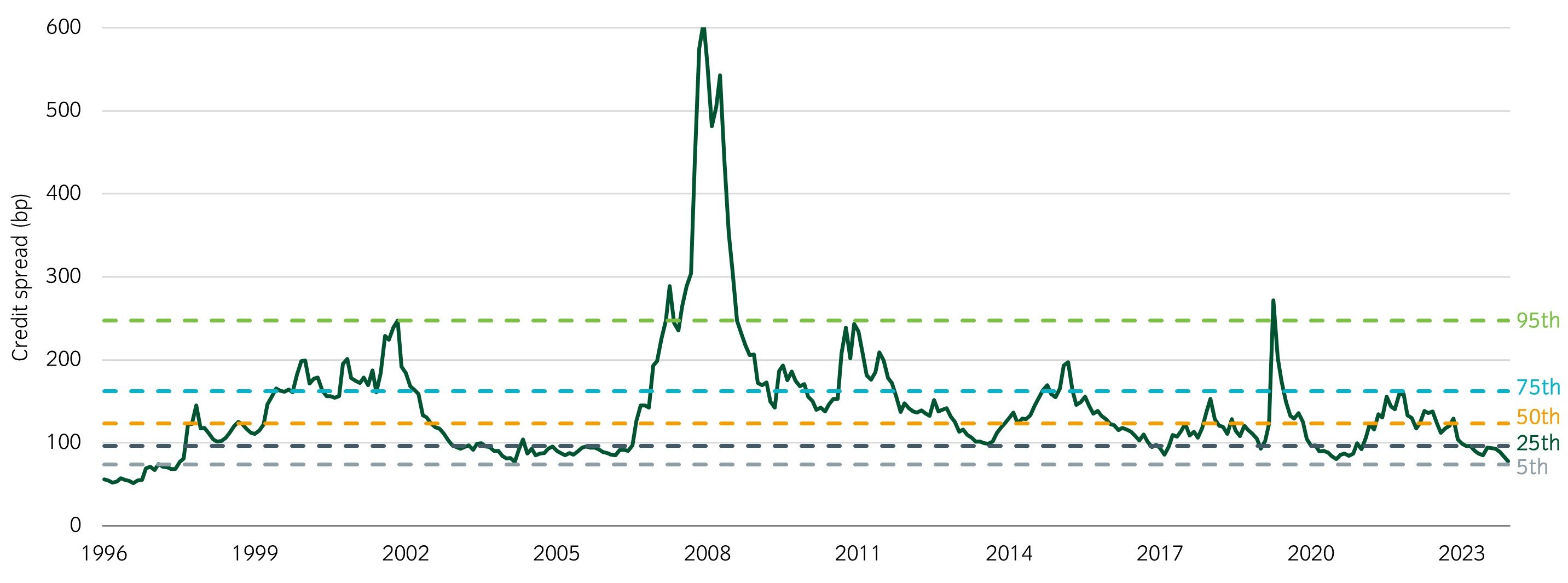

5. Revisit the credit spread hedge ratio

Credit spreads have tightened significantly, presenting both opportunities and risks. While further tightening is possible, the downside risks are pronounced. Plan sponsors should assess their credit spread hedge ratios, considering the correlation with return-seeking portfolios and the historical behavior of spreads during risk-off periods, which often mirror broader market drawdowns.

Figure 5: US investment grade credit spreads (bp) and percentiles

Source: Bloomberg US Corporate IG Index (LUACTRUU) as of November 29, 2024, Insight calculations

The current economic environment and the costs associated with trading physical credit make a compelling case for exploring alternative strategies. Dynamic management of credit spread exposure through overlays – particularly instruments like CDX – can provide a more flexible and cost-effective solution. By leveraging overlay strategies, plan sponsors can systematically adjust their spread exposure in response to market conditions, reducing transaction costs while maintaining liquidity.

This approach also enables sponsors to monetize spread volatility through a disciplined framework. For example, increasing spread exposure during periods of widening spreads and taking gains when spreads tighten can help enhance portfolio efficiency. These tailored solutions are designed to align with sponsors’ risk management objectives and optimize long-term returns, helping to ensure portfolios are better positioned to navigate shifting market conditions.

Conclusion: Position your LDI strategy for your changing circumstances

The environment is changing for LDI investors. Improved funding ratios provide a menu of options for plans to secure their end-state in the most certain and economically beneficial way for plan sponsors and their beneficiaries.

Most read

Global macro

April 2022

Global Macro Research: Modeling the persistence of US inflation

Global macro, Fixed income

May 2023

Global Macro Research: Debt ceiling stand off

Liability-driven investment, Fixed income, Responsible investment

December 2023

Thoughts for 2024

Fixed income

June 2024

United States

United States