Rate cuts under review…

The stickiness in inflation and the resultant back-up in yields have delivered a more challenging backdrop for risk assets of late, largely because of the speed with which yields have risen. In that context, a key question is how much further the rates complex will shift.

We have already come a long way from the six rate cuts priced in at the start of the year to the single cut currently priced in. Indeed, for the short end of the yield curve to move materially higher, the market would have to seriously entertain the prospect of additional rate hikes. This ‘too hot’ scenario is clearly a risk. In this world, activity remains strong enough for inflation to become problematic and real rates start to breakout to the upside. The pace and extent of any breakout in real yields would have both economic implications and be a potential source of stress for risk assets more broadly – certainly, from a relative valuation perspective, a 10-year US Treasury yield above 5% might prove challenging for stocks.

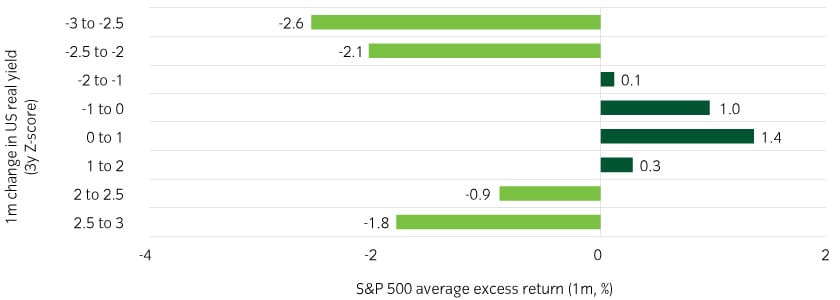

…and rates of change matter

As we have noted before, equity markets can normally cope with real rates rising so long as it is against a backdrop where the growth environment is good. That said, the rate at which rates are backing up matters. As Figure 1 illustrates, excessively sharp rises in rates have been associated with negative equity market returns.

Figure 1: Rates of change in real yields matter for risk assets

Source: Insight and Bloomberg as at 30 April 2024.

This, however, is not our base case. The statement from the early May US Federal Open Market Committee (FOMC) meeting included the comment that the Committee “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals”. We interpret this to mean we are a long way from the point where rate hikes will be under consideration.

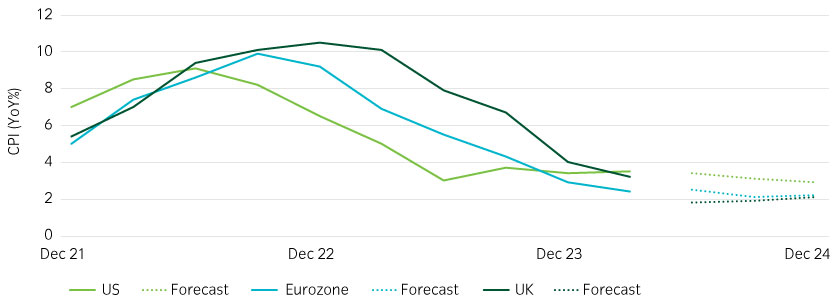

The last leg in the battle of bringing inflation down is proving hard, but overall there has been good progress and, as is often said, the lags with which monetary policy works are long and uncertain.

Figure 2: Inflation – realised and forecast

Source: Insight and Bloomberg as at 30 April 2024.

There have been many areas of the economy that have been hurt by rising interest rates – property sectors, manufacturing, the poor and the indebted – but there have been offsetting forces that have limited the damage so that the cost to the broader economy, in terms of unemployment, has thus far been minimal. That said, expectations are already pointing to softer times ahead. Admittedly, this has been said many times before, but data such as hiring intentions in the NFIB survey and rising layoff announcements suggest softer labour-market data to come. Indeed, the April US jobs report showed the smallest payrolls gain in six months, while wage growth fell, and unemployment ticked up. One report will not cause rate expectations to volte-face, but it should be a reminder that the lagged effects of policy tightening are still working their way through.

For now, we expect that a softening in the employment and consumption data will be offset by improvements in the manufacturing and profits cycle and, in that environment, rates volatility is likely to subside, assuming the next few inflation prints would not surprise to the upside.

Risk of rare regime territory

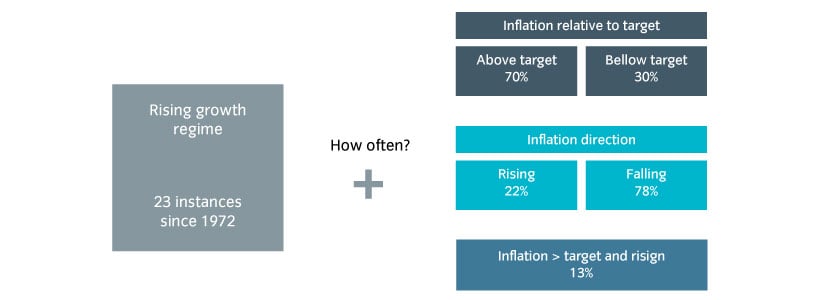

Our regime-based asset allocation framework helps us assess likely asset-class behaviours in different growth, inflation, and real rate environments. To summarise our investment thesis, since Q4 2023 growth dynamics appeared to be stabilising; inflation, whilst above central bank targets, was on its way down; and this in turn has meant the direction of real rates was no longer persistently upwards. Valuations and positioning extremes can complicate the picture, but purely from a cyclical standpoint that has historically been a constructive investment backdrop.

More recently, this constructive cyclical set-up has been challenged by sticky inflation prints. We still characterise the growth environment as ‘rising’. In practical terms this can still be a challenging environment – in PMI terms, readings are often below 50, but are trending upwards. Most often, these ‘early cycle’ phases come after periods of contraction (PMIs below 50 and falling) and are accompanied by falling inflation trends (as inflation trends often follow activity, but with a material lag). Figure 3 shows the historical behaviour of inflation for all previous periods of rising growth, with inflation above target and rising only occurring 13% of the time.

Figure 3: A rare growth and inflation regime mix

Source: Insight. For illustrative purposes only.

Cycles out of synchronisation

Of course, this has much to do with the unique circumstances surrounding the pandemic when the manufacturing and services cycles were bumped out of synchronisation. Having been the first to benefit from demand while swathes of the population were in various forms of lockdown, manufacturing struggled in the face of higher costs and satiated demand, while services rebounded later, driven by pent-up demand fuelled by excess savings and incomes from tight labour markets.

The strength of the labour markets across much of the developed world is one of the notable features of the current cycle. The reasons behind it are no doubt complex but, to some degree, it may reflect a change in behaviour of firms, reluctant to shed labour given the perceived difficulties in re-hiring. The challenge for the Fed is whether inflation can fully normalise when consumption is strong, supported by so many people in jobs.

Of course, the Fed has a dual growth and inflation mandate, so of all the major central banks it can ease policy even if growth is good. Chairman Powell has been explicit in that regard. But the path to that end is a narrow one. Consumption needs to moderate and the labour market cool to some degree, which will keep inflation on a downward path, while at the same time, manufacturing and profits can continue to recover.

To put the challenge another way, the normal cycle remains out of synchronisation with manufacturing activity in what we’d describe as an early cycle recovery, while services and employment have a distinctly late-cycle feel to them. A successful outturn for the Fed would be this experience ending up viewed as a mid-cycle slowdown, which would leave the aggregate economy in a better form of balance.

At this point, the trend in inflation is hard to discern but, if we assume the recent (say three-month) trend is going to hold, it would put us in an environment of rising growth but both inflation and real rates moving higher. Such a combination is rare – indeed, we’ve only seen this twice in the last 50 years.

Anticipating a stabilisation in the rates complex we retain our pro-cyclical stance for now

Against these uncertainties we retain a pro-cyclical asset allocation largely because we still see the growth backdrop as supportive. For risk assets, most obviously equity, our regime analysis tells us that the growth dynamic tends to be the most dominant force in terms of determining whether it is a good or bad time to be fully invested. That would suggest a pro-cyclical bias would still be appropriate.

If in the months ahead both inflation and real rates trends are upward, this would temper our cyclical enthusiasm as it may imply weaker times ahead via a tightening in financial conditions and the threat of more restrictive policy to come. So, a stabilisation in the rates complex is needed. The recent back-up in bond yields has got to the point where bond investors, including our own rates team, see opportunities, and given that view we have retained much of our cyclical exposures.

For more thoughts from our multi-asset team click here.

United Kingdom

United Kingdom