Interview with Jeffrey Burger, Senior Portfolio Manager, Insight Investment

In our view, we are seeing some of the best opportunities in municipal bonds for decades. We believe we are currently in a window of generationally high yields for what are intrinsically, very safe investments. They could be a good fit for investors seeking to exploit the rise in yields with low default prospects. They can also be a great diversifier in portfolios, allowing investors to diversify without sacrificing returns. A good example of the diversification was shown during the rates sell off at the start of 2024.

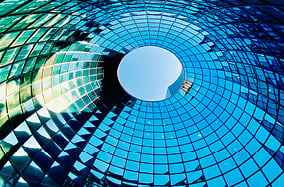

Figure 1: Munis outperformed Treasuries during Q1 2024 rate sell off1

How is the delay in cutting rates impacting municipal bonds?

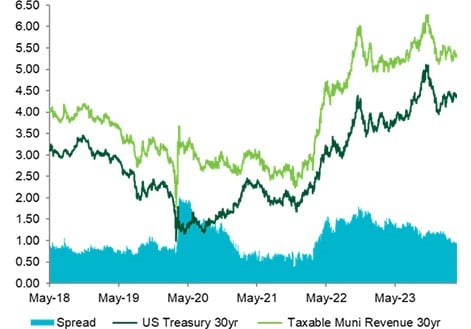

Even though the Federal Reserve is currently on hold, we still expect some easing in policy towards year end. We believe broad curve exposure will continue to provide a yield benefit courtesy of the inverted curve slope. Adding exposure to taxable municipal bonds beyond 10-year maturities where the curve is steep offers a favourable income and return profile in a falling rate environment.

How might US elections impact on municipal bonds?

Historically, municipal bonds have tended to achieve positive returns during presidential election years, while issuance tends to be front-loaded toward the first half of the year as some issuers become hesitant to bring deals closer to the November. The market expects a modest expansion of issuance by about 5%-10% to around $400-425bn in 2024.

Figure 2: Taxable munis versus US treasury 30-year yield2

How does the credit quality of municipal bond issuers compare to Treasuries?

A growing US federal deficit means Treasury issuance is expected to continue to balloon. This cannot be good news for the US Treasury market in the long run. While credit quality for munis may have already peaked, most state and local governments are well positioned due to building up reserve funds in recent years.

How does the credit quality of municipal bond issuers compare to corporate bonds?

US munis provide significantly better credit quality, comparable yield, and less chance of defaulting than many investment grade corporate bonds. In aggregate, taxable municipal bonds tend to have a higher credit rating relative to US investment grade corporates.

Which parts of the municipal bond market do you favour? What are you staying away from?

From a sector perspective we are maintaining a bias toward overweighting essential service revenue bonds (water/sewer, electric utilities). These offer attractive yields and solid fundamental credit profiles. By contrast, state and local general obligation (GO) issues are backed by more cyclical sources of tax revenues which could soften in an economic downturn. These factors, combined with lower yield spreads for GO issues, led us to target an underweight to revenue bonds.

Elsewhere, we continue to see good value in airport and toll road credits due to the recovery of air and vehicular travel to pre-pandemic levels. We also continue to search for idiosyncratic buying opportunities across all sectors as well as quality ranges.

How do municipal bonds perform in a downturn?

Historically, municipal bonds have held up very well from a credit perspective during times of market stress, in large part because of the essential nature of the asset class. Many US municipal governments are also sitting on ‘rainy day’ money that would be used if the wider economy suffers a downturn. It is also very rare indeed for a municipal bond, particularly those that are rated investment grade, to default2.

What is your current role?

As the lead portfolio manager for our non-US investor base part of my responsibility is interfacing with our global audience. That is important because US municipal bonds are a relatively under researched asset class for many non-US investors. Communicating and sharing information on this market with those who may be less familiar with the sector is something I take very seriously.

United Kingdom

United Kingdom