Why Insight for pooled LDI solutions

Simplicity: less complex than many traditional segregated LDI solutions; pooled solutions are easy to implement and reporting is clear and concise. The funds can be combined with Insight's return-seeking funds or with those from an external manager.

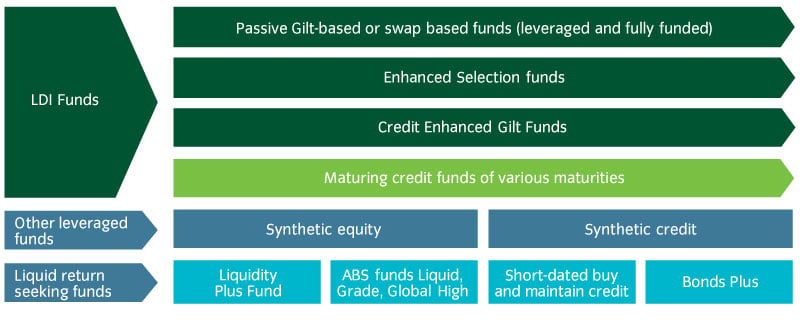

Flexibility: you can isolate the specific risk to hedge - interest rate, inflation, or both - and the timing of each, select the most appropriate type and mix of funds to meet your specific needs. Our range includes partially-funded portfolios, meaning you can plan an effective hedge using only a portion of your assets, helping to maximise the value of assets free to invest for growth.

Performance: we continue to improve our solutions to deliver maximum value for our clients.

Market leader: we have grown to become one of the world's largest managers of LDI solutions.2 This has allowed us to gain unique experience of successfully helping the widest range of clients develop and implement robust long-term funding strategies. In 2023 Insight was ranked in first place for Overall LDI Quality for the 13th consecutive year with UK investment consultants, based on Coalition Greenwich Associates' 2023 research.1

Partnerships for the long term: we are committed to building strong and lasting partnerships based on trust, competence and effective communication. Our skilled and experienced professionals work collaboratively with our clients and their advisers, ensuring that their strategies are tailored for their specific circumstances, and respond quickly and effectively to their changing needs.

United Kingdom

United Kingdom